Bitget: Auf Platz 4 im weltweiten täglichen Handelsvolumen!

BTC-Marktanteil61.97%

Neue Listings auf Bitget : Pi Network

BTC/USDT$83177.98 (-0.08%)Angst und Gier Index28(Angst)

Altcoin-Saison-Index:0(Bitcoin-Saison)

In Pre-Market gelistete CoinsPAWS,WCTGesamtnettozufluss des Bitcoin-ETF -$99.8M (1T); -$14.7M (7T).Willkommensgeschenkpaket für neue Nutzer im Wert von 6.200 USDT.Jetzt beanspruchen

Handeln Sie jederzeit und überall mit der Bitget-App. Jetzt herunterladen

Bitget: Auf Platz 4 im weltweiten täglichen Handelsvolumen!

BTC-Marktanteil61.97%

Neue Listings auf Bitget : Pi Network

BTC/USDT$83177.98 (-0.08%)Angst und Gier Index28(Angst)

Altcoin-Saison-Index:0(Bitcoin-Saison)

In Pre-Market gelistete CoinsPAWS,WCTGesamtnettozufluss des Bitcoin-ETF -$99.8M (1T); -$14.7M (7T).Willkommensgeschenkpaket für neue Nutzer im Wert von 6.200 USDT.Jetzt beanspruchen

Handeln Sie jederzeit und überall mit der Bitget-App. Jetzt herunterladen

Bitget: Auf Platz 4 im weltweiten täglichen Handelsvolumen!

BTC-Marktanteil61.97%

Neue Listings auf Bitget : Pi Network

BTC/USDT$83177.98 (-0.08%)Angst und Gier Index28(Angst)

Altcoin-Saison-Index:0(Bitcoin-Saison)

In Pre-Market gelistete CoinsPAWS,WCTGesamtnettozufluss des Bitcoin-ETF -$99.8M (1T); -$14.7M (7T).Willkommensgeschenkpaket für neue Nutzer im Wert von 6.200 USDT.Jetzt beanspruchen

Handeln Sie jederzeit und überall mit der Bitget-App. Jetzt herunterladen

Coin bezogen

Preis-Rechner

Preisverlauf

Preisprognose

Technische Analyse

Leitfaden zum Kauf von Coins

Kategorie Krypto

Gewinn-Rechner

Major Kurs MAJOR

Gelistet

Quotierte Währung:

EUR

€0.1232-7.43%1D

Preisübersicht

TradingView

Zuletzt aktualisiert 2025-04-04 06:31:24(UTC+0)

Marktkapitalisierung:€10,265,629.48

Vollständig verwässerte Marktkapitalisierung:€10,265,629.48

24S-Volumen:€26,122,133.28

24S-Volumen / Marktkapitalisierung:254.46%

24S Hoch:€0.1343

24S Tief:€0.1197

Allzeithoch:€33.19

Allzeittief:€0.08969

Tokens im Umlauf:83,349,870 MAJOR

Gesamtangebot:

99,999,999MAJOR

Zirkulationsrate:83.00%

Max. Angebot:

99,999,999MAJOR

Preis in BTC:0.{5}1638 BTC

Preis in ETH:0.{4}7550 ETH

Preis bei BTC-Marktkapitalisierung:

€17,900.05

Preis bei ETH-Marktkapitalisierung:

€2,361.7

Verträge:

EQCuPm...U_MAJOR(TON)

Mehr

Wie denken Sie heute über Major?

Hinweis: Diese Information ist nur als Referenz gedacht.

Preis von Major heute

Der aktuelle Kurs von Major liegt heute bei €0.1232 pro (MAJOR / EUR) mit einer aktuellen Marktkapitalisierung von €10.27M EUR. Das 24-Stunden-Trading-Volumen beträgt €26.12M EUR. MAJOR bis EUR wird der Preis in Echtzeit aktualisiert. Major ist -7.43% in den letzten 24 Stunden. Es hat 83,349,870 Tokens im Umlauf.

Was ist der höchste Preis von MAJOR?

MAJOR hat ein Allzeithoch (ATH) von €33.19, aufgezeichnet am 2024-11-27.

Was ist der niedrigste Preis von MAJOR?

MAJOR hat ein Allzeittief (ATL) von €0.08969, aufgezeichnet am 2025-03-11.

Major Preisprognose

Wann ist ein guter Zeitpunkt, um MAJOR zu kaufen? Sollte ich MAJOR jetzt kaufen oder verkaufen?

Bei der Entscheidung, ob Sie MAJOR kaufen oder verkaufen sollen, müssen Sie zunächst Ihre eigene Handelsstrategie berücksichtigen. Die Handelsaktivitäten von Langzeit- und Kurzzeit-Tradern werden ebenfalls unterschiedlich sein. Der Bitget MAJOR technische Analyse kann Ihnen eine Referenz fürs Traden bieten.

Gemäß der MAJOR 4S Technische Analyse ist das Trading-Signal Verkauf.

Gemäß der MAJOR 1T Technische Analyse ist das Trading-Signal Starker Verkauf.

Gemäß der MAJOR 1W Technische Analyse ist das Trading-Signal Starker Verkauf.

Wie hoch wird der Preis von MAJOR in 2026 sein?

Auf Grundlage des Modells zur Vorhersage der vergangenen Kursentwicklung von MAJOR wird der Preis von MAJOR in 2026 voraussichtlich €0.1581 erreichen.

Wie hoch wird der Preis von MAJOR in 2031 sein?

In 2031 wird der Preis von MAJOR voraussichtlich um +22.00% steigen. Am Ende von 2031 wird der Preis von MAJOR voraussichtlich €0.2710 erreichen, mit einem kumulativen ROI von +125.66%.

Major Preisverlauf (EUR)

Der Preis von Major ist -90.31% über das letzte Jahr. Der höchste Preis von MAJORNEW in EUR im letzten Jahr war €33.19 und der niedrigste Preis von MAJORNEW in EUR im letzten Jahr war €0.08969.

ZeitPreisänderung (%) Niedrigster Preis

Niedrigster Preis Höchster Preis

Höchster Preis

Niedrigster Preis

Niedrigster Preis Höchster Preis

Höchster Preis

24h-7.43%€0.1197€0.1343

7d-20.17%€0.1197€0.1501

30d-4.05%€0.08969€0.2315

90d-77.60%€0.08969€0.5797

1y-90.31%€0.08969€33.19

Allzeit-89.10%€0.08969(2025-03-11, 24 Tag(e) her )€33.19(2024-11-27, 128 Tag(e) her )

Major Markt-Informationen

Major Verlauf der Marktkapitalisierung

Marktkapitalisierung

€10,265,629.48

Vollständig verwässerte Marktkapitalisierung

€12,316,311.5

Markt-Ranglisten

Major Bestände nach Konzentration

Whales

Investoren

Einzelhandel

Major Adressen nach Haltezeit

Inhaber

Cruiser

Trader

Live coinInfo.name (12) Preis-Chart

Major Bewertungen

Durchschnittliche Bewertungen in der Community

4.2

Dieser Inhalt dient nur zu Informationszwecken.

MAJOR in lokaler Währung

1 MAJOR zu MXN$2.721 MAJOR zu GTQQ1.051 MAJOR zu CLP$129.471 MAJOR zu HNLL3.491 MAJOR zu UGXSh496.831 MAJOR zu ZARR2.561 MAJOR zu TNDد.ت0.421 MAJOR zu IQDع.د178.61 MAJOR zu TWDNT$4.481 MAJOR zu RSDдин.14.411 MAJOR zu DOP$8.61 MAJOR zu MYRRM0.611 MAJOR zu GEL₾0.381 MAJOR zu UYU$5.761 MAJOR zu MADد.م.1.31 MAJOR zu AZN₼0.231 MAJOR zu OMRر.ع.0.051 MAJOR zu KESSh17.621 MAJOR zu SEKkr1.331 MAJOR zu UAH₴5.63

- 1

- 2

- 3

- 4

- 5

Zuletzt aktualisiert 2025-04-04 06:31:24(UTC+0)

Wie man Major(MAJOR) kauft

Erstellen Sie Ihr kostenloses Bitget-Konto

Melden Sie sich bei Bitget mit Ihrer E-Mail-Adresse/Handynummer an und erstellen Sie ein sicheres Passwort, um Ihr Konto zu schützen.

Verifizieren Sie Ihr Konto

Verifizieren Sie Ihre Identität, indem Sie Ihre persönlichen Daten eingeben und einen gültigen Lichtbildausweis hochladen.

Major in MAJOR konvertieren

Verwenden Sie eine Vielzahl von Zahlungsoptionen, um Major auf Bitget zu kaufen. Wir zeigen Ihnen, wie.

Mehr erfahrenMAJOR-Perpetual-Futures traden

Nachdem Sie sich erfolgreich bei Bitget angemeldet und USDT oder MAJOR Token gekauft haben, können Sie mit dem Trading von Derivaten beginnen, einschließlich MAJOR Futures und Margin-Trading, um Ihr Einkommen zu erhöhen.

Der aktuelle Preis von MAJOR ist €0.1232, mit einer 24h-Preisänderung von -7.43%. Trader können von Futures profitieren, indem sie entweder Long- oder Short-Positionen eingehen.

Schließen Sie sich MAJOR Copy-Trading an, indem Sie Elite-Tradern folgen.

Nach der Anmeldung bei Bitget und dem erfolgreichen Kauf von USDT- oder -Token können Sie auch mit dem Copy-Trading beginnen, indem Sie Elite-Tradern folgen.

Major Nachrichten

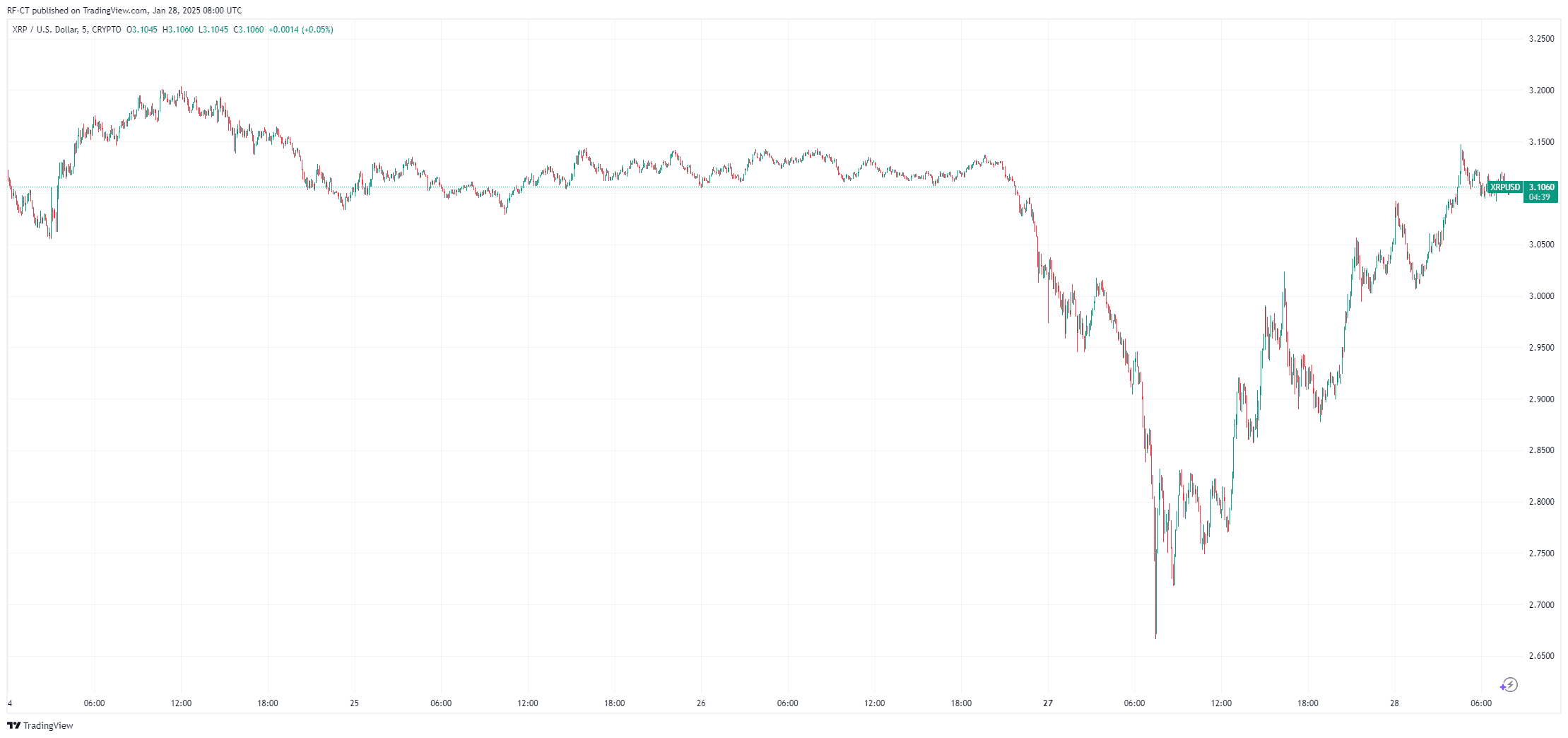

MAJOR XRP News: MTL Lizenz, Null Kapitalertragssteuer und Ripple SEC Lösung in Sicht

XRP ist in den letzten 24 Stunden um 11 % gestiegen, angetrieben von bahnbrechenden Nachrichten wie Null Kapitalertragssteuer, regulatorischen Erfolgen und möglichen Fortschritten im Rechtsstreit.

Cryptoticker•2025-01-28 19:12

So hoch könnten XRP und XLM Experten zufolge 2025 steigen

Kryptoszene•2025-01-07 05:44

IOTA-News: 2025 bekommt IOTA sein bisher größtes Upgrade

CryptoNewsFlash•2024-12-31 17:00

Wichtig: Die Mietbörse ist offiziell live

Bitget•2024-12-17 02:41

Neue Listings auf Bitget

Neue Listings

Mehr kaufen

FAQ

Wie hoch ist der aktuelle Preis von Major?

Der Live-Kurs von Major ist €0.12 pro (MAJOR/EUR) mit einer aktuellen Marktkapitalisierung von €10,265,629.48 EUR. Der Wert von Major unterliegt aufgrund der kontinuierlichen 24/7-Aktivität auf dem Kryptomarkt häufigen Schwankungen. Der aktuelle Preis von Major in Echtzeit und seine historischen Daten sind auf Bitget verfügbar.

Wie hoch ist das 24-Stunden-Trading-Volumen von Major?

In den letzten 24 Stunden beträgt das Trading-Volumen von Major €26.12M.

Was ist das Allzeithoch von Major?

Das Allzeithoch von Major ist €33.19. Dieses Allzeithoch ist der höchste Preis für Major seit seiner Einführung.

Kann ich Major auf Bitget kaufen?

Ja, Major ist derzeit in der zentralen Börse von Bitget verfügbar. Ausführlichere Anweisungen finden Sie in unserem hilfreichen Wie man major kauft Leitfaden.

Kann ich mit Investitionen in Major ein regelmäßiges Einkommen erzielen?

Natürlich bietet Bitget einen strategische Trading-Plattform, mit intelligenten Trading-Bots, um Ihre Trades zu automatisieren und Gewinne zu erzielen.

Wo kann ich Major mit der niedrigsten Gebühr kaufen?

Wir freuen uns, ankündigen zu können, dass strategische Trading-Plattform jetzt auf der Bitget-Börse verfügbar ist. Bitget bietet branchenführende Handelsgebühren und -tiefe, um profitable Investitionen für Trader zu gewährleisten.

Wo kann ich Major (MAJOR) kaufen?

Videobereich - schnelle Verifizierung, schnelles Trading

Wie Sie die Identitätsverifizierung auf Bitget durchführen und sich vor Betrug schützen

1. Loggen Sie sich bei Ihrem Bitget-Konto ein.

2. Wenn Sie neu bei Bitget sind, schauen Sie sich unser Tutorial an, wie Sie ein Konto erstellen.

3. Bewegen Sie den Mauszeiger über Ihr Profilsymbol, klicken Sie auf "Unverifiziert" und dann auf "Verifizieren".

4. Wählen Sie Ihr Ausstellungsland oder Ihre Region und den Ausweistyp und folgen Sie den Anweisungen.

5. Wählen Sie je nach Präferenz "Mobile Verifizierung" oder "PC".

6. Geben Sie Ihre Daten ein, legen Sie eine Kopie Ihres Ausweises vor und machen Sie ein Selfie.

7. Reichen Sie Ihren Antrag ein, und voilà, Sie haben die Identitätsverifizierung abgeschlossen!

Kryptowährungs-Investitionen, einschließlich des Kaufs von Major online über Bitget, unterliegen dem Marktrisiko. Bitget bietet Ihnen einfache und bequeme Möglichkeiten, Major zu kaufen, und wir versuchen unser Bestes, um unsere Nutzer über jede Kryptowährung, die wir auf der Börse anbieten, umfassend zu informieren. Wir sind jedoch nicht verantwortlich für die Ergebnisse, die sich aus Ihrem Major Kauf ergeben können. Diese Seite und alle darin enthaltenen Informationen sind keine Empfehlung für eine bestimmte Kryptowährung.

Bitget Insights

Mushtaque_15

2S

🔥 Shiba Inu (SHIB) Market Analysis – Critical Levels Ahead! 🔥

🔹 Current Price: $0.00001225

🔹 Support Levels: $0.00001400 (previous), now at $0.00001000

🔹 Resistance Levels: $0.00001400, $0.00002000

Key Observations:

✅ Struggling to Hold Key Support: SHIB has lost its previous $0.00001400 support and is now testing $0.00001000—the last major support before a potential price collapse.

✅ Trend Analysis: SHIB remains in a long-term downtrend, with no confirmed breakout yet. If it fails to reclaim $0.00001400, further downside is expected.

✅ Bearish Warning: Losing $0.00001000 could result in SHIB adding another zero (dropping below $0.00001000)—bringing it to price levels not seen since 2022.

Price Predictions & Scenarios:

📉 Bearish Case:

Failure to reclaim $0.00001400 → Retest of $0.00001000

Loss of $0.00001000 → SHIB could drop towards $0.00000100 (10x decrease)

🚀 Bullish Case:

Holds $0.00001000 and reclaims $0.00001400 → Next target is $0.00002000

Two daily candle closes above $0.00001400 → Potential for a trend reversal

Final Thoughts:

📊 SHIB is at a critical crossroads! If it holds $0.00001000, we could see recovery attempts. But a breakdown will likely lead to new multi-year lows. Traders should watch for confirmation above $0.00001400 before considering bullish positions.

$SHIB

X-0.23%

HOLD+6.94%

Crypto-Ticker

4S

Top 3 Reasons why EOS Price is UP Despite the Crypto Market Crash

While Bitcoin and the broader crypto market are under pressure, EOS is showing unexpected strength: The token is currently priced at $0.84, marking a 5% daily gain and an impressive 46% increase over the past week. With a market cap of $1.32 billion, EOS is back on traders’ radars. Although its all-time high of $19 is still far off, the recent surge is catching attention.

EOS/USD 1-day chart - TradingView

What’s behind this pump? Here are the Top 3 reasons why EOS is soaring—despite market uncertainty.

The biggest price driver? EOS is undergoing a major transformation. By the end of May 2025, the project will officially rebrand as Vaulta, shifting its focus to blockchain-powered banking solutions—a hot topic in a market hungry for real-world use cases.

As part of this rebrand, the EOS token will transition into Vaulta, with a new ticker expected to be announced later this April. The core technology remains intact, including integration with exSat, a Bitcoin-based banking solution. This strategic shift is injecting fresh momentum—and clearly driving the price higher.

Vaulta aims to position itself as a top staking option, offering an impressive 17% yield. For comparison, Ethereum currently offers around 2%, and Solana sits at roughly 5%.

These rewards are backed by a staking pool of approximately 250 million Vaulta tokens. In a bearish market, such high yields become particularly attractive to investors—creating a strong incentive to jump in early.

--> Earn on EOS with Bitget staking <--

EOS is also seeing strong activity in the derivatives market. According to CoinGlass, open interest in EOS futures has surged over 30%, reaching an 11-month high of $144.14 million.

Even more interesting: The funding rate has flipped positive, indicating that more traders are now betting on the upside. This signals clear market sentiment—many expect EOS to climb even further in the near term.

While most altcoins are struggling, EOS is gaining momentum—and it’s not just luck. With the upcoming Vaulta rebrand, lucrative staking rewards, and bullish derivatives data, the token has multiple strong narratives supporting its rally. If the crypto market stabilizes, EOS could turn out to be one of 2025’s biggest surprises.

While Bitcoin and the broader crypto market are under pressure, EOS is showing unexpected strength: The token is currently priced at $0.84, marking a 5% daily gain and an impressive 46% increase over the past week. With a market cap of $1.32 billion, EOS is back on traders’ radars. Although its all-time high of $19 is still far off, the recent surge is catching attention.

EOS/USD 1-day chart - TradingView

What’s behind this pump? Here are the Top 3 reasons why EOS is soaring—despite market uncertainty.

The biggest price driver? EOS is undergoing a major transformation. By the end of May 2025, the project will officially rebrand as Vaulta, shifting its focus to blockchain-powered banking solutions—a hot topic in a market hungry for real-world use cases.

As part of this rebrand, the EOS token will transition into Vaulta, with a new ticker expected to be announced later this April. The core technology remains intact, including integration with exSat, a Bitcoin-based banking solution. This strategic shift is injecting fresh momentum—and clearly driving the price higher.

Vaulta aims to position itself as a top staking option, offering an impressive 17% yield. For comparison, Ethereum currently offers around 2%, and Solana sits at roughly 5%.

These rewards are backed by a staking pool of approximately 250 million Vaulta tokens. In a bearish market, such high yields become particularly attractive to investors—creating a strong incentive to jump in early.

--> Earn on EOS with Bitget staking <--

EOS is also seeing strong activity in the derivatives market. According to CoinGlass, open interest in EOS futures has surged over 30%, reaching an 11-month high of $144.14 million.

Even more interesting: The funding rate has flipped positive, indicating that more traders are now betting on the upside. This signals clear market sentiment—many expect EOS to climb even further in the near term.

While most altcoins are struggling, EOS is gaining momentum—and it’s not just luck. With the upcoming Vaulta rebrand, lucrative staking rewards, and bullish derivatives data, the token has multiple strong narratives supporting its rally. If the crypto market stabilizes, EOS could turn out to be one of 2025’s biggest surprises.

WHY+0.16%

CORE-2.33%

Crypto-Ticker

4S

Buy SHIB Now or Regret Later? This Chart May Have the Answer!

Shiba Inu (SHIB) , the meme-inspired token turned DeFi and metaverse contender, continues to attract speculative eyes despite its recent decline. After an explosive run in 2021, SHIB's price action has since cooled , hovering near support zones as investors await a catalyst. The latest daily and hourly charts reveal a tight tug-of-war between bears and bulls — but could a breakout be closer than it appears? Let’s dive deep into the current technical structure and what it could mean for SHIB holders in the days ahead.

The daily chart paints a picture of prolonged bearish pressure. SHIB price is currently trading at $0.00001212 , marking a 2.36% decline for the day. More importantly, the price has continued to reject the 50-day Simple Moving Average (SMA) and remains under all key SMAs — the 20, 50, 100, and 200-day — a clear sign of bearish dominance.

The Moving Average Ribbon (SMA Ribbon) reveals a descending alignment, with no sign of crossover, which generally indicates a sustained downtrend. The 200-day SMA at $0.00001912 is especially significant; reclaiming it would mark a major trend reversal. Until then, SHIB remains in a long-term downtrend .

Volume indicators, while not explicitly shown here, correlate with the Accumulation/Distribution Line (ADL), which is flattening and showing a slight decline — implying that whales and smart money are not actively accumulating at current levels. This weak accumulation could mean investors are waiting for a stronger dip or a news-driven catalyst.

--> Click here to Buy SHIB on Bitget <--

Switching to the hourly chart, the picture becomes a bit more nuanced. Shiba Inu Price showed a slight intraday rebound , gaining 0.96% from its previous hourly close. However, this bounce ran into immediate resistance at the 50-hour SMA, currently around $0.00001247, and got rejected. This intraday weakness indicates that short-term bulls lack conviction.

Interestingly, the ADL on the hourly chart is attempting to curl upward after forming a base, suggesting small pockets of accumulation during dips. However, this remains weak and inconsistent. The 200-hour SMA looms above at $0.00001309, which now acts as the critical resistance barrier for any short-term recovery.

Despite the minor price uptick, the SMA Ribbon continues to slope downward — reinforcing the idea that any rallies may be short-lived unless a breakout over the 100-hour and 200-hour SMAs occurs with strong volume.

--> Click here to Buy SHIB on Bitget <--

On the daily timeframe, the Heikin Ashi candles are red and flat-bottomed, confirming a strong bearish trend with no significant wicks to the downside — this implies clean selling pressure without much buying support. Unless SHIB price prints a green Heikin Ashi candle with a higher high and longer upper wick, the trend remains unchanged.

The SMA indicators are stacked bearishly (20 < 50 < 100 < 200), forming a classic downward ribbon. This is a textbook sign of a persistent downtrend with little chance of reversal unless a bullish crossover emerges — particularly the 20-day SMA flipping above the 50-day.

The ADL also reflects more distribution than accumulation, weakening the case for a near-term breakout.

On the hourly chart, while a small bounce occurred, the resistance at the 100-hour and 200-hour SMAs proved too strong. The ADL uptick may indicate a short squeeze or opportunistic buys, but it doesn't suggest a trend reversal just yet.

--> Click here to Buy SHIB on Bitget <--

In the near term, if Shiba Inu price fails to hold support at $0.00001200, it could revisit recent lows near $0.00001150. On the flip side, a clean breakout above $0.00001250 with a strong green Heikin Ashi candle and bullish ADL divergence might push SHIB toward the psychological resistance at $0.00001300.

However, a sustainable uptrend would require SHIB price to break above $0.00001370 (the 100-day SMA) and reclaim $0.00001690 to invalidate the bearish structure and regain bullish momentum.

Right now, Shiba Inu is in no man's land — caught between weak support and strong resistance. The daily trend is decisively bearish, while the hourly chart hints at speculative bounces rather than solid accumulation.

Unless a news catalyst, such as a SHIB ecosystem update or broader crypto rally, injects new volume, it’s likely that Shiba Inu price will continue to drift or drop further. For traders, this is a wait-and-watch zone. For long-term holders, any deeper dip may provide a better accumulation opportunity — but only with risk management in place.

Shiba Inu (SHIB) , the meme-inspired token turned DeFi and metaverse contender, continues to attract speculative eyes despite its recent decline. After an explosive run in 2021, SHIB's price action has since cooled , hovering near support zones as investors await a catalyst. The latest daily and hourly charts reveal a tight tug-of-war between bears and bulls — but could a breakout be closer than it appears? Let’s dive deep into the current technical structure and what it could mean for SHIB holders in the days ahead.

The daily chart paints a picture of prolonged bearish pressure. SHIB price is currently trading at $0.00001212 , marking a 2.36% decline for the day. More importantly, the price has continued to reject the 50-day Simple Moving Average (SMA) and remains under all key SMAs — the 20, 50, 100, and 200-day — a clear sign of bearish dominance.

The Moving Average Ribbon (SMA Ribbon) reveals a descending alignment, with no sign of crossover, which generally indicates a sustained downtrend. The 200-day SMA at $0.00001912 is especially significant; reclaiming it would mark a major trend reversal. Until then, SHIB remains in a long-term downtrend .

Volume indicators, while not explicitly shown here, correlate with the Accumulation/Distribution Line (ADL), which is flattening and showing a slight decline — implying that whales and smart money are not actively accumulating at current levels. This weak accumulation could mean investors are waiting for a stronger dip or a news-driven catalyst.

--> Click here to Buy SHIB on Bitget <--

Switching to the hourly chart, the picture becomes a bit more nuanced. Shiba Inu Price showed a slight intraday rebound , gaining 0.96% from its previous hourly close. However, this bounce ran into immediate resistance at the 50-hour SMA, currently around $0.00001247, and got rejected. This intraday weakness indicates that short-term bulls lack conviction.

Interestingly, the ADL on the hourly chart is attempting to curl upward after forming a base, suggesting small pockets of accumulation during dips. However, this remains weak and inconsistent. The 200-hour SMA looms above at $0.00001309, which now acts as the critical resistance barrier for any short-term recovery.

Despite the minor price uptick, the SMA Ribbon continues to slope downward — reinforcing the idea that any rallies may be short-lived unless a breakout over the 100-hour and 200-hour SMAs occurs with strong volume.

--> Click here to Buy SHIB on Bitget <--

On the daily timeframe, the Heikin Ashi candles are red and flat-bottomed, confirming a strong bearish trend with no significant wicks to the downside — this implies clean selling pressure without much buying support. Unless SHIB price prints a green Heikin Ashi candle with a higher high and longer upper wick, the trend remains unchanged.

The SMA indicators are stacked bearishly (20 < 50 < 100 < 200), forming a classic downward ribbon. This is a textbook sign of a persistent downtrend with little chance of reversal unless a bullish crossover emerges — particularly the 20-day SMA flipping above the 50-day.

The ADL also reflects more distribution than accumulation, weakening the case for a near-term breakout.

On the hourly chart, while a small bounce occurred, the resistance at the 100-hour and 200-hour SMAs proved too strong. The ADL uptick may indicate a short squeeze or opportunistic buys, but it doesn't suggest a trend reversal just yet.

--> Click here to Buy SHIB on Bitget <--

In the near term, if Shiba Inu price fails to hold support at $0.00001200, it could revisit recent lows near $0.00001150. On the flip side, a clean breakout above $0.00001250 with a strong green Heikin Ashi candle and bullish ADL divergence might push SHIB toward the psychological resistance at $0.00001300.

However, a sustainable uptrend would require SHIB price to break above $0.00001370 (the 100-day SMA) and reclaim $0.00001690 to invalidate the bearish structure and regain bullish momentum.

Right now, Shiba Inu is in no man's land — caught between weak support and strong resistance. The daily trend is decisively bearish, while the hourly chart hints at speculative bounces rather than solid accumulation.

Unless a news catalyst, such as a SHIB ecosystem update or broader crypto rally, injects new volume, it’s likely that Shiba Inu price will continue to drift or drop further. For traders, this is a wait-and-watch zone. For long-term holders, any deeper dip may provide a better accumulation opportunity — but only with risk management in place.

NEAR+0.27%

MAJOR+0.07%

Mirza-Sahib786

4S

Trump's Reciprocal Tariffs Measures

President Trump's announcement of reciprocal tariffs has sparked significant interest and concern globally. The proposed measures aim to address trade deficits and promote fair trade practices, but their impact on the economy and consumers is a pressing concern.

Understanding Reciprocal Tariffs:

Reciprocal tariffs involve equalizing US import tariffs with those imposed by its trading partners. This approach could have substantial implications, particularly if applied to a broader range of foreign taxes, such as value-added taxes and digital services taxes.

Potential Consequences:

The introduction of reciprocal tariffs may lead to:

Increased Costs for Consumers: Higher tariffs could result in increased prices for various goods, including autos and everyday items.

Retaliatory Measures: US trading partners may impose their own tariffs on US goods, potentially escalating into a trade war.

Economic Uncertainty: The impact of tariffs on business confidence and investment decisions could be significant.

Impact on US Trading Partners:

Major US trading partners, including China, the European Union, and Japan, may face

$TRUMP significant tariff rates under the new measures:

China: 34% tariff rate

European Union: 20% tariff rate

Japan: 24% tariff rate

Economic Projections:

According to J.P. Morgan Research, the introduction of reciprocal tariffs could lead to:

Reduced US GDP Growth: Heightened trade policy uncertainty and existing tariffs may weigh on activity growth.

Increased Inflation: Tariffs could push up consumer prices, with potential implications for inflation forecasts.

The introduction of reciprocal tariffs is a complex issue with far-reaching implications. Understanding the potential consequences and impact on various stakeholders is crucial for informed decision-making. As the situation continues to evolve, staying informed about the latest developments and analysis will be essential.

MAJOR+0.07%

UP+6.01%

MALOOK-E-STORE

5S

$PI Any major news and BOOM 🚀

MAJOR+0.07%

PI-3.34%

Verwandte Assets

Beliebte Kryptowährungen

Eine Auswahl der 8 wichtigsten Kryptowährungen nach Marktkapitalisierung.

Kürzlich hinzugefügt

Die zuletzt hinzugefügten Kryptowährungen.

Vergleichbare Marktkapitalisierung

Von allen Bitget-Assets sind diese 8 in Bezug auf die Marktkapitalisierung am nächsten an Major dran.

.png)