En lien avec la crypto

Calculateur de prix

Historique des prix

Prédiction de prix

Analyse technique

Guide d'achat crypto

Catégorie de crypto

Calculateur de profit

Prix de BarnBridgeBOND

Que pensez-vous de BarnBridge aujourd'hui ?

Prix de BarnBridge aujourd'hui

Quel est le prix le plus élevé de BOND ?

Quel est le prix le plus bas de BOND ?

Prédiction de prix de BarnBridge

Quel est le bon moment pour acheter BOND ? Dois-je acheter ou vendre BOND maintenant ?

Quel sera le prix de BOND en 2026 ?

Quel sera le prix de BOND en 2031 ?

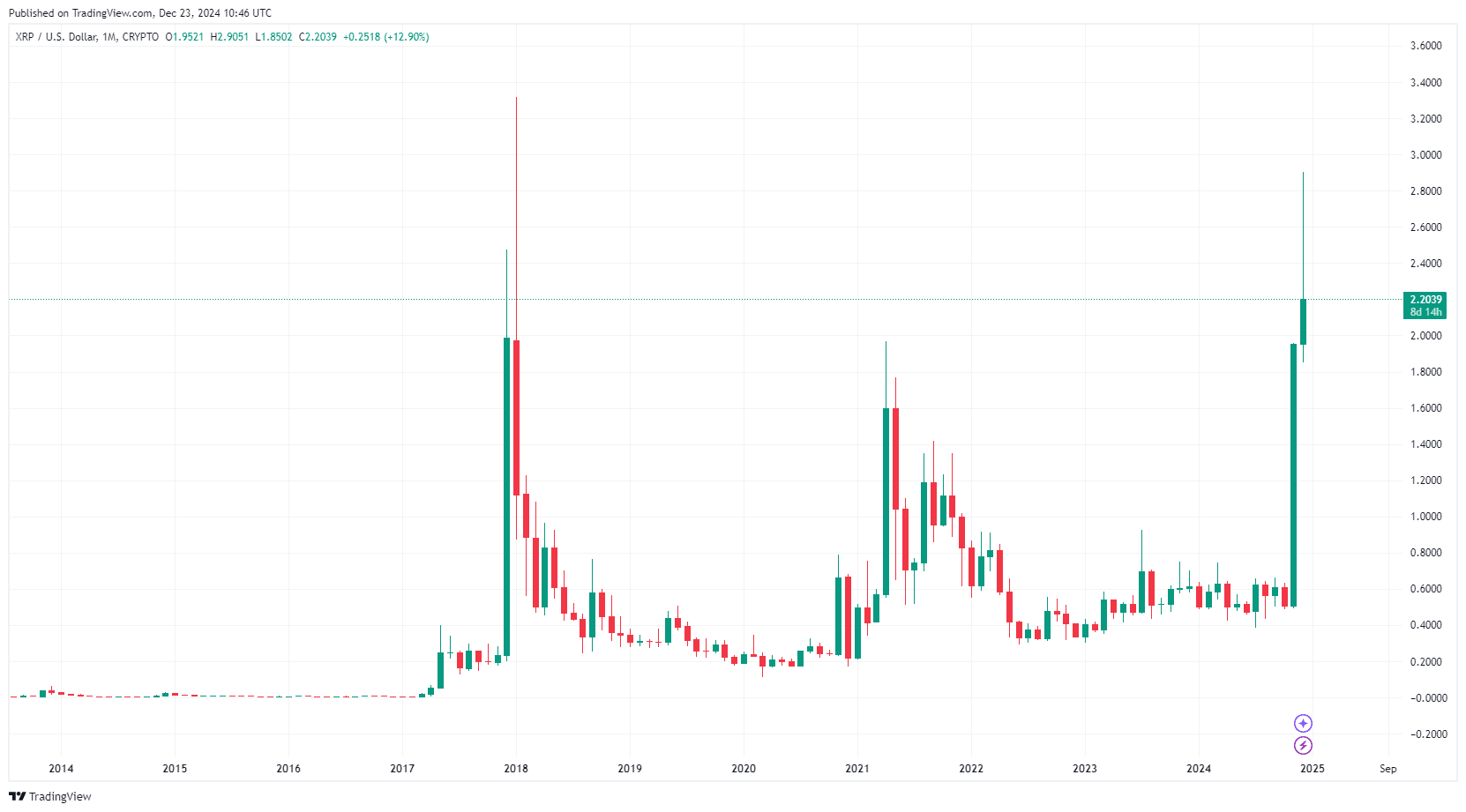

Historique des prix de BarnBridge (USD)

Prix le plus bas

Prix le plus bas Prix le plus élevé

Prix le plus élevé

Données de marché de BarnBridge

Historique de capitalisation BarnBridge

Marché BarnBridge

Avoirs BarnBridge par concentration

Adresses BarnBridge par durée de détention

Notes BarnBridge

À propos de BarnBridge (BOND)

Cryptocurrency, aussi connue sous le nom de monnaie numérique ou monnaie virtuelle, est devenue un sujet brûlant ces dernières années. L'une des crypto-monnaies qui a récemment gagné en popularité est BarnBridge. BarnBridge est une plateforme de finance décentralisée (DeFi) qui vise à rationaliser et à diversifier les portefeuilles de crypto-monnaies. Il s'agit d'un protocole unique qui permet aux utilisateurs de fractionner leurs actifs numériques en différents pools de risque. Cela signifie que les investisseurs peuvent diversifier leurs risques en répartissant leurs actifs dans différents pools avec différents niveaux de risque. Une caractéristique clé de BarnBridge est l'utilisation de la technologie des contrats intelligents. Les contrats intelligents permettent d'exécuter automatiquement les termes d'un accord sans avoir besoin d'un tiers de confiance. Dans le cas de BarnBridge, cela signifie que les investisseurs peuvent participer à des pools de risques spécifiques et recevoir des rendements proportionnels à leur contribution sans avoir à faire confiance à une partie centralisée. BarnBridge utilise également des "tokens" pour faciliter les transactions et la participation à sa plateforme. Les tokens sont des représentations numériques d'actifs ou de droits qui peuvent être échangés sur un réseau blockchain. Dans le cas de BarnBridge, les tokens sont utilisés pour représenter les différentes pools de risque et permettre aux utilisateurs d'investir et de négocier ces actifs numériques. Ce qui distingue BarnBridge des autres crypto-monnaies, c'est son approche novatrice pour gérer les risques dans l'univers crypto. En permettant aux investisseurs de diversifier leurs actifs numériques et de choisir des niveaux de risque adaptés à leurs préférences, BarnBridge offre une solution attrayante pour les investisseurs cherchant à maximiser leurs rendements tout en minimisant les risques. En résumé, BarnBridge est une plateforme de finance décentralisée qui vise à rationaliser et à diversifier les portefeuilles de crypto-monnaies. Grâce à l'utilisation de contrats intelligents et de tokens, BarnBridge permet aux investisseurs de gérer leurs risques de manière plus efficace tout en offrant des rendements attractifs. Cette approche innovante positionne BarnBridge comme une crypto-monnaie prometteuse dans le paysage en constante évolution de la finance décentralisée.

BOND en devise locale

- 1

- 2

- 3

- 4

- 5

Comment acheter BarnBridge(BOND)

Créez votre compte Bitget gratuitement

Vérifiez votre compte

Acheter BarnBridge (BOND)

Rejoignez le copy trading de BOND en suivant des traders experts.

Actualités BarnBridge

Le cours du XRP oscille autour d'un niveau de soutien crucial de 2,20 $, suscitant des débats sur son avenir. Va-t-il remonter jusqu'à 10 dollars ou faire face à des baisses jusqu'à 1 dollar ?

Acheter plus

FAQ

Quel est le prix actuel de BarnBridge ?

Quel est le volume de trading sur 24 heures de BarnBridge ?

Quel est le record historique de BarnBridge ?

Puis-je acheter BarnBridge sur Bitget ?

Puis-je gagner des revenus réguliers en investissant dans BarnBridge ?

Où puis-je acheter des BarnBridge au meilleur prix ?

Où puis-je acheter BarnBridge (BOND) ?

Section vidéo – vérifier son identité rapidement

Bitget Insights

Actifs liés

Données sociales de BarnBridge

Au cours des dernières 24 heures, le score de sentiment sur les réseaux sociaux de BarnBridge est de 5, et le sentiment sur les réseaux sociaux concernant la tendance du prix de BarnBridge est Haussier. Le score global de BarnBridge sur les réseaux sociaux est de 1,213, ce qui le classe au 360ème rang parmi toutes les cryptomonnaies.

Selon LunarCrush, au cours des dernières 24 heures, les cryptomonnaies ont été mentionnées sur les réseaux sociaux un total de 1,058,120 fois. BarnBridge a été mentionné avec un taux de fréquence de 0%, se classant au 541ème rang parmi toutes les cryptomonnaies.

Au cours des dernières 24 heures, 194 utilisateurs uniques ont discuté de BarnBridge, avec un total de 43 mentions de BarnBridge. Toutefois, par rapport à la période de 24 heures précédente, le nombre d'utilisateurs uniques a augmenté de 6%, et le nombre total de mentions a diminué de 4%.

Sur X, il y a eu un total de 1 posts mentionnant BarnBridge au cours des dernières 24 heures. Parmi eux, 100% sont haussiers sur BarnBridge, 0% sont baissiers sur BarnBridge, et 0% sont neutres sur BarnBridge.

Sur Reddit, il y a eu 31 posts mentionnant au cours des dernières 24 heures. Par rapport à la période de 24 heures précédente, le nombre de mentions diminué a augmenté de 26%.

Aperçu social

5