Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア61.99%

BTC/USDT$82959.00 (-1.40%)恐怖・強欲指数30(恐怖)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨PAWS,WCTビットコイン現物ETFの純流入総額(-$64.9M(1日)、-$169.2M(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア61.99%

BTC/USDT$82959.00 (-1.40%)恐怖・強欲指数30(恐怖)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨PAWS,WCTビットコイン現物ETFの純流入総額(-$64.9M(1日)、-$169.2M(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Bitget:日次取引量の世界ランキングでトップ4にランクイン!

BTCマーケットシェア61.99%

BTC/USDT$82959.00 (-1.40%)恐怖・強欲指数30(恐怖)

アルトコインシーズン指数:0(ビットコインシーズン)

プレマーケットに上場した通貨PAWS,WCTビットコイン現物ETFの純流入総額(-$64.9M(1日)、-$169.2M(7日))。6,200 USDT相当の新規ユーザー向けウェルカムギフトパッケージ。今すぐ獲得する

Bitgetアプリでいつでもどこでも取引しましょう今すぐダウンロードする

Legend of Arcadiaの価格ARCA

上場済み

決済通貨:

JPY

¥3.3+0.51%1D

価格チャート

TradingView

最終更新:2025-04-05 20:52:20(UTC+0)

時価総額:--

完全希薄化の時価総額:--

24時間取引量:¥21,650,951.87

24時間取引量 / 時価総額:0.00%

24時間高値:¥3.35

24時間安値:¥3.26

過去最高値:¥6.82

過去最安値:¥2.37

循環供給量:-- ARCA

総供給量:

1,000,000,000ARCA

流通率:0.00%

最大供給量:

1,000,000,000ARCA

BTCでの価格:0.{6}2704 BTC

ETHでの価格:0.{4}1254 ETH

BTC時価総額での価格:

--

ETH時価総額での価格:

--

コントラクト:

0xDD17...5977AcF(Base)

もっと

Legend of Arcadiaに投票しましょう!

注:この情報はあくまでも参考情報です。

今日のLegend of Arcadiaの価格

Legend of Arcadia の今日の現在価格は、(ARCA / JPY)あたり¥3.3 で、現在の時価総額は¥0.00 JPYです。24時間の取引量は¥21.65M JPYです。ARCAからJPYの価格はリアルタイムで更新されています。Legend of Arcadia は0.51%過去24時間で変動しました。循環供給は0 です。

ARCAの最高価格はいくらですか?

ARCAの過去最高値(ATH)は2024-12-27に記録された¥6.82です。

ARCAの最安価格はいくらですか?

ARCAの過去最安値(ATL)は2024-11-17に記録され¥2.37です。

Legend of Arcadiaの価格予測

2026年のARCAの価格はどうなる?

ARCAの過去の価格パフォーマンス予測モデルによると、ARCAの価格は2026年に¥3.36に達すると予測されます。

2031年のARCAの価格はどうなる?

2031年には、ARCAの価格は+1.00%変動する見込みです。 2031年末には、ARCAの価格は¥4.76に達し、累積ROIは+43.78%になると予測されます。

Legend of Arcadiaの価格履歴(JPY)

Legend of Arcadiaの価格は、この1年で-35.70%を記録しました。直近1年間のJPY建てARCAの最高値は¥6.82で、直近1年間のJPY建てARCAの最安値は¥2.37でした。

時間価格変動率(%) 最低価格

最低価格 最高価格

最高価格

最低価格

最低価格 最高価格

最高価格

24h+0.51%¥3.26¥3.35

7d-3.07%¥3.24¥3.53

30d-8.11%¥3.15¥3.74

90d-30.63%¥3.15¥5.09

1y-35.70%¥2.37¥6.82

すべての期間-35.38%¥2.37(2024-11-17, 140 日前 )¥6.82(2024-12-27, 100 日前 )

Legend of Arcadiaの市場情報

Legend of Arcadia市場

Legend of Arcadiaの集中度別保有量

大口

投資家

リテール

Legend of Arcadiaの保有時間別アドレス

長期保有者

クルーザー

トレーダー

coinInfo.name(12)のリアル価格チャート

Legend of Arcadiaの評価

コミュニティからの平均評価

4.6

このコンテンツは情報提供のみを目的としたものです。

ARCAから現地通貨

1 ARCA から MXN$0.461 ARCA から GTQQ0.171 ARCA から CLP$21.611 ARCA から HNLL0.571 ARCA から UGXSh81.721 ARCA から ZARR0.431 ARCA から TNDد.ت0.071 ARCA から IQDع.د29.381 ARCA から TWDNT$0.741 ARCA から RSDдин.2.41 ARCA から DOP$1.411 ARCA から MYRRM0.11 ARCA から GEL₾0.061 ARCA から UYU$0.941 ARCA から MADد.م.0.211 ARCA から OMRر.ع.0.011 ARCA から AZN₼0.041 ARCA から SEKkr0.221 ARCA から KESSh2.91 ARCA から UAH₴0.93

- 1

- 2

- 3

- 4

- 5

最終更新:2025-04-05 20:52:20(UTC+0)

Legend of Arcadia(ARCA)の購入方法

無料でBitgetアカウントを作成します

Eメールアドレス/携帯電話番号でBitgetに登録し、アカウントを保護するために強力なパスワードを作成します。

アカウントを認証する

個人情報を入力し、有効な写真付き身分証明書をアップロードして本人確認(KYC認証)を行います。

Legend of ArcadiaをARCAに交換

BitgetでLegend of Arcadiaを購入するには、様々なお支払い方法をご利用いただけます。

詳細はこちらエリートトレーダーをフォローして、ARCAのコピートレードを始めましょう。

Bitgetに登録し、USDTまたはARCAトークンを購入した後、エリートトレーダーをフォローしてコピートレードを開始することもできます。

Legend of Arcadiaのニュース

Bitget現物Botに3取引ペア追加のお知らせ

Bitget Announcement•2024-12-16 12:56

アルカディアの未来価値の伝説を掘り下げる:$ARCAの潜在的な上昇余地の分析

远山洞见•2024-11-06 10:06

Legend of Arcadia(ARCA):おもちゃのヒーローファンタジーの世界に遊びと収入をもたらす

Bitget Academy•2024-11-05 07:24

本日のトップ5上昇: ARCA 24時間で238.45%増加

Bitget•2024-11-05 00:21

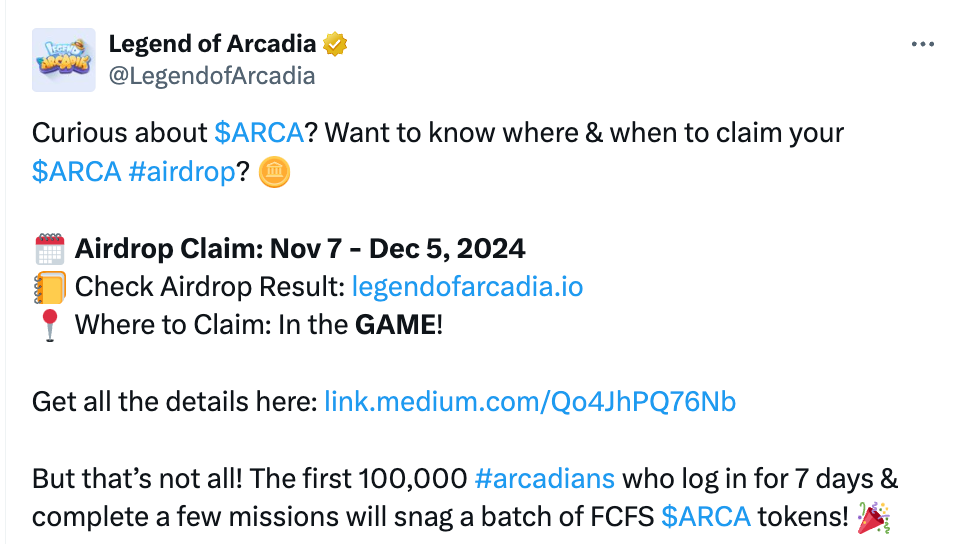

最初の10万人のアルカディアンが7日間ログインし、いくつかのミッションを完了すると、先着順で$ARCAトークンを獲得

X•2024-11-04 07:08

もっと購入する

よくあるご質問

Legend of Arcadiaの現在の価格はいくらですか?

Legend of Arcadiaのライブ価格は¥3.3(ARCA/JPY)で、現在の時価総額は¥0 JPYです。Legend of Arcadiaの価値は、暗号資産市場の24時間365日休みない動きにより、頻繁に変動します。Legend of Arcadiaのリアルタイムでの現在価格とその履歴データは、Bitgetで閲覧可能です。

Legend of Arcadiaの24時間取引量は?

過去24時間で、Legend of Arcadiaの取引量は¥21.65Mです。

Legend of Arcadiaの過去最高値はいくらですか?

Legend of Arcadia の過去最高値は¥6.82です。この過去最高値は、Legend of Arcadiaがローンチされて以来の最高値です。

BitgetでLegend of Arcadiaを購入できますか?

はい、Legend of Arcadiaは現在、Bitgetの取引所で利用できます。より詳細な手順については、お役立ちlegend-of-arcadiaの購入方法 ガイドをご覧ください。

Legend of Arcadiaに投資して安定した収入を得ることはできますか?

もちろん、Bitgetは戦略的取引プラットフォームを提供し、インテリジェントな取引Botで取引を自動化し、利益を得ることができます。

Legend of Arcadiaを最も安く購入できるのはどこですか?

戦略的取引プラットフォームがBitget取引所でご利用いただけるようになりました。Bitgetは、トレーダーが確実に利益を得られるよう、業界トップクラスの取引手数料と流動性を提供しています。

Legend of Arcadia(ARCA)はどこで買えますか?

動画セクション - 素早く認証を終えて、素早く取引へ

Bitgetで本人確認(KYC認証)を完了し、詐欺から身を守る方法

1. Bitgetアカウントにログインします。

2. Bitgetにまだアカウントをお持ちでない方は、アカウント作成方法のチュートリアルをご覧ください。

3. プロフィールアイコンにカーソルを合わせ、「未認証」をクリックし、「認証する」をクリックしてください。

4. 発行国または地域と身分証の種類を選択し、指示に従ってください。

5. 「モバイル認証」または「PC」をご希望に応じて選択してください。

6. 個人情報を入力し、身分証明書のコピーを提出し、自撮りで撮影してください。

7. 申請書を提出すれば、本人確認(KYC認証)は完了です。

Bitgetを介してオンラインでLegend of Arcadiaを購入することを含む暗号資産投資は、市場リスクを伴います。Bitgetでは、簡単で便利な購入方法を提供しており、取引所で提供している各暗号資産について、ユーザーに十分な情報を提供するよう努力しています。ただし、Legend of Arcadiaの購入によって生じる結果については、当社は責任を負いかねます。このページおよび含まれる情報は、特定の暗号資産を推奨するものではありません。

Bitgetインサイト

CryptoNews

14時

Grayscale Files S-1 Form With SEC for Solana ETF Without SOL Staking Function

Investment giant Gra

Grayscale Files S-1 Form With SEC for Solana ETF Without SOL Staking Function

Investment giant Grayscale is filing to rename its prospective Solana (SOL) exchange-traded fund (ETF) while removing staking from the trust. In a new S-1 Filing with the U.S. Securities and Exchange Commission (SEC), Grayscale says it intends to rename its previously filed trust, Grayscale Solana Trust, to Grayscale Solana Trust ETF. “In connection with this registration statement, on December 3, 2024, NYSE Arca filed an application with the Securities and Exchange Commission (the ‘SEC’) pursuant to Rule 19b-4 under the Securities Exchange Act of 1934, as amended (the ‘Exchange Act’), to list the Shares of Grayscale Solana Trust (SOL) (the ‘Trust’) on NYSE Arca (the ’19b-4 Application’). As of the date of this filing, the 19b-4 Application has not been approved by the SEC. The Trust makes no representation as to when or .

$SOL

ARCA-0.98%

SOL-3.17%

Trader5

2日

Grayscale Files S3 for Crypto ETF Featuring XRP and Trump’s Top Crypto Picks

Grayscale has recently

Grayscale Files S3 for Crypto ETF Featuring XRP and Trump’s Top Crypto Picks

Grayscale has recently filed an updated S3 registration statement for its Digital Large Cap Exchange-Traded Fund (ETF). This fund is designed to offer diversified exposure to a broad range of cryptocurrencies, including major altcoins like Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP.

As part of this initiative, NYSE Arca submitted a separate 19b-4 application on October 15, 2024, to list shares of the Grayscale Digital Large Cap ETF (GDLC). This application is currently under review by the U.S. Securities and Exchange Commission (SEC), with key deadlines approaching. The SEC has set an initial decision deadline for May 3, with a final ruling expected by July 2.

“Today, we filed a registration statement on Form S-3 to register shares of Grayscale Digital Large Cap Fund (ticker: GDLC) under the Securities Act of .

ETH-1.81%

ARCA-0.98%

Trader5

3日

Grayscale Seeks SEC Approval to List Crypto ETF With BTC, ETH, XRP, SOL, ADA Holdings

Grayscale has

Grayscale Seeks SEC Approval to List Crypto ETF With BTC, ETH, XRP, SOL, ADA Holdings

Grayscale has filed with the SEC to list its digital large cap fund as an ETF on NYSE Arca, offering exposure to bitcoin, ethereum, XRP, solana, and cardano.

Grayscale’s Digital Large Cap Fund Targets NYSE Arca Listing for Broader Crypto Exposure

Crypto asset manager Grayscale Investments filed a Form S-3 registration statement with the U.S. Securities and Exchange Commission (SEC) on March 31 to register and list shares of its Grayscale Digital Large Cap Fund on the NYSE Arca under the symbol GDLC. The move would convert the fund into an exchange-traded fund (ETF) and expand public trading access to a diversified digital asset fund composed of major cryptocurrencies.

Grayscale shared on social media platform X:

Today, we filed a registration statement on Form S-3 to register shares of Grayscale Digital Large Cap.

BTC-1.15%

X+4.49%

Aicoin-EN-Bitcoincom

3日

Grayscale Seeks SEC Approval to List Crypto ETF With BTC, ETH, XRP, SOL, ADA Holdings

Crypto asset manager Grayscale Investments filed a Form S-3 registration statement with the U.S. Securities and Exchange Commission (SEC) on March 31 to register and list shares of its Grayscale Digital Large Cap Fund on the NYSE Arca under the symbol GDLC. The move would convert the fund into an exchange-traded fund (ETF) and expand public trading access to a diversified digital asset fund composed of major cryptocurrencies.

Grayscale shared on social media platform X:

Today, we filed a registration statement on Form S-3 to register shares of Grayscale Digital Large Cap Fund (ticker: GDLC) under the Securities Act of 1933. This is another important step toward uplisting GDLC as an ETP. GDLC holds the top 5 crypto assets by market cap.

However, the launch remains dependent on SEC approval of a separate 19b-4 application submitted by NYSE Arca in October 2024. “The Fund will not seek effectiveness of this registration statement and no offering of shares hereunder will take place unless and until such approval is obtained,” Grayscale affirmed.

The fund’s holdings are determined by the Coindesk Large Cap Select Index (DLCS), which selects the top digital assets by market capitalization that meet specific criteria, such as availability on Coinbase Custody and exclusion of stablecoins and meme coins. As of March 31, the fund holds five assets: bitcoin ( BTC), ethereum ( ETH), XRP, solana ( SOL), and cardano ( ADA). As of writing, the portfolio composition by weight includes: bitcoin at 79.40%, ethereum at 10.69%, XRP at 5.85%, solana at 2.92%, and cardano at 1.14%.

“The fund’s investment objective is for the value of the shares (based on NAV per share) to reflect the value of the digital assets held by the fund … plus any cash held by the fund and reduced by the fund’s expenses and other liabilities,” Grayscale explained. Currently, only cash-based creation and redemption of shares are available, and no staking of the fund’s assets is permitted.

Grayscale also addressed the significant historical trading discounts on OTCQX, where the fund’s shares have frequently traded below net asset value (NAV). From July 1, 2022, to Dec. 31, 2024, the maximum observed discount was 63%, with an average of 40%. That discount narrowed to 12% by year-end 2024 and stood at 10% as of March 18. The firm believes that exchange listing and a redemption program could align share price with NAV. The filing detailed:

Upon listing on NYSE Arca, the manager expects the market price of the shares and the NAV per share to converge.

The fund uses Coinbase Custody Trust Company as custodian, The Bank of New York Mellon as administrator and transfer agent, and operates under Cayman Islands regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

BTC-1.15%

ETH-1.81%

MartyParty_

2025/03/27 00:50

#Solana ETF Update: @Fidelity joins 6 other applicants waiting on #SEC approval under new @CBOE BZX 14.11 (e)(4) rule change to "Commodity Based Share Trusts" - to make #SEC approved Spot Solana ETFs.

If any of these get approved then $SOL is reclassified a "commodity" by the #SEC and joins only $BTC and $ETH with this status. $SOL is already classified as a commodity by the #CFTC who approved the listing of @VolShares $SOL Futures products recently.

Franklin Templeton @FTI_US

Franklin Templeton, a major asset manager with over $1.5 trillion in assets, filed for a spot Solana ETF with the SEC. The filing includes both S-1 and 19b-4 forms, with the proposed Franklin Solana ETF intended to be listed on the Cboe BZX Exchange. The SEC has acknowledged this filing, marking a significant step forward. The review process is ongoing, with public comments being sought as part of the standard procedure.

VanEck @vaneck_us

VanEck was one of the first to file for a spot Solana ETF, submitting its 19b-4 application on June 27, 2024, followed by an S-1 form. The filing was added to the Federal Register on February 19, 2025, triggering a 240-day review period, with a potential approval decision expected by October 2025. The ETF is also proposed for listing on the Cboe BZX Exchange.

21Shares @21Shares

21Shares filed its spot Solana ETF application shortly after VanEck on June 28, 2024. Like VanEck’s, this filing was officially added to the Federal Register on February 19, 2025, setting a potential approval deadline in October 2025. It is also slated for the Cboe BZX Exchange.

Bitwise @bitwise

Bitwise submitted an S-1 form for its spot Solana ETF in November 2024, after withdrawing an earlier Delaware trust filing. The 19b-4 form was refiled and added to the Federal Register on February 19, 2025, aligning its review timeline with VanEck and 21Shares for a possible October 2025 decision. The Bitwise Solana ETF is planned for listing on the Cboe BZX Exchange.

Canary Capital @CanaryFunds

Canary Capital filed for a spot Solana ETF in late October 2024, with its application joining the others in the Federal Register on February 19, 2025. This sets its potential approval timeline to October 2025 as well, with the Cboe BZX Exchange as the proposed listing venue.

Grayscale @Grayscale

Grayscale filed a 19b-4 form on December 3, 2024, to convert its existing Grayscale Solana Trust (GSOL) into a spot ETF, to be listed on the NYSE Arca. The SEC acknowledged this filing, and it entered the public comment phase, with a notable deadline for a decision set for October 2025 following its Federal Register listing. This application is distinct as it involves converting an existing trust rather than launching a new fund.

Fidelity @Fidelity

Fidelity recently joined the race by filing an application for a spot Solana ETF, with Cboe submitting the necessary paperwork. While specific dates are less clear compared to others, it is part of the ongoing wave of Solana ETF proposals under SEC review as of early 2025.

BTC-1.15%

ETH-1.81%

関連資産

最近追加された暗号資産

最も最近追加された暗号資産

同等の時価総額

すべてのBitget資産の中で、時価総額がLegend of Arcadiaに最も近いのはこれらの8資産です。