News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (March 11)|Strategy raises $21 billion, possible BTC buy, Tesla stock plunges2Franklin Templeton joins XRP race and VanEck eyes AVAX fund amid altcoin ETF craze3Bitcoin and Crypto About To Be Boosted by Global Money Supply Explosion: Former Goldman Sachs Executive

Texas Senate Passes Bitcoin Reserve Bill With 80% Votes in Favor

Texas' Bitcoin Reserve bill cleared the Senate with strong bipartisan support. Without mandatory Bitcoin purchases, it now moves to the House for a final vote.

BeInCrypto·2025/03/06 15:36

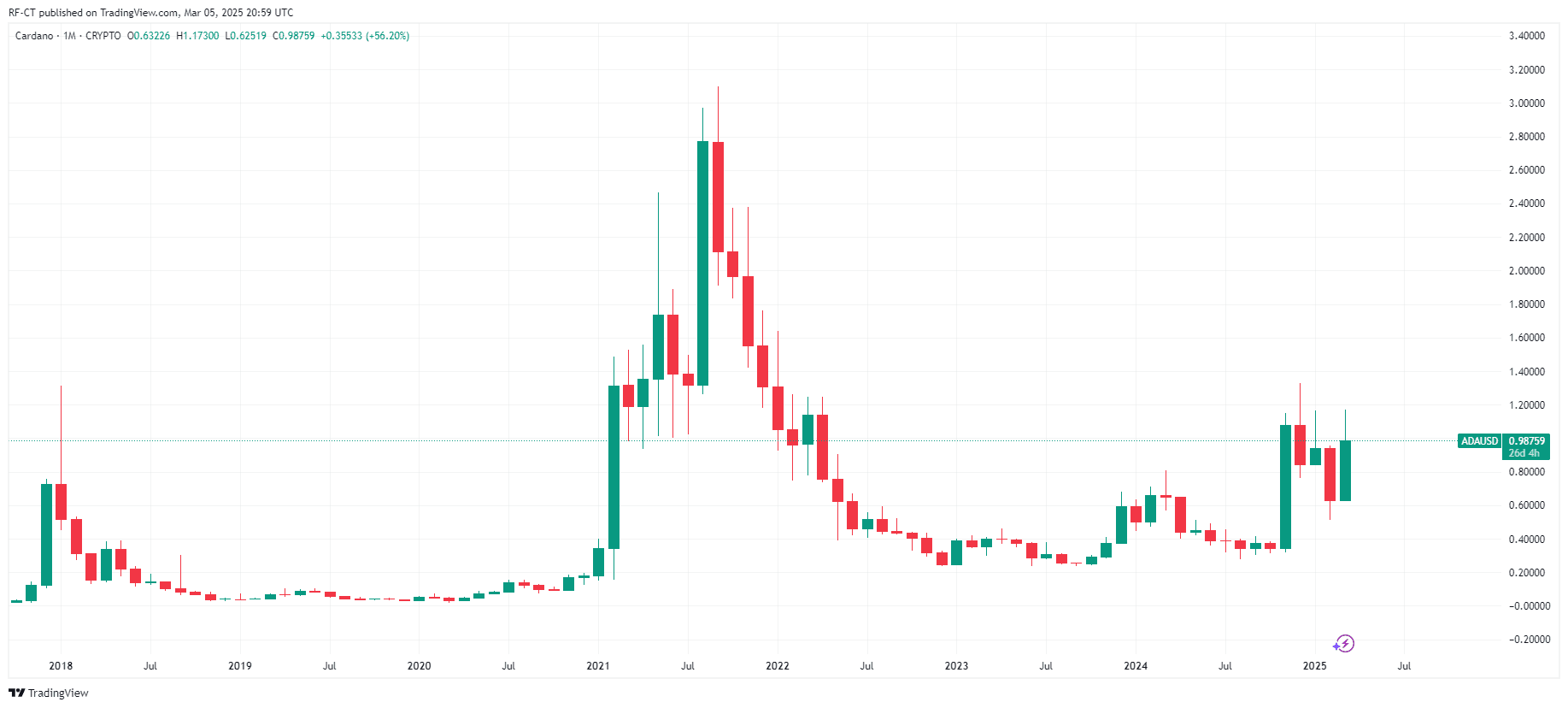

Cardano (ADA) Might Struggle to Retain $1 Amid US Reserve Debate

ADA’s uptrend is losing strength as resistance at $1 proves tough to break. Whale activity and ADX trends suggest potential consolidation ahead.

BeInCrypto·2025/03/06 15:30

Research Report | In-Depth Analysis of the RedStone & RED Token Market Value

西格玛学长·2025/03/06 14:57

Cardano Price Prediction: ADA Eyes Breakout Above $1.50 Resistance for a Major Rally

Cryptoticker·2025/03/06 11:44

ONDO Hits New All-Time High In TVL – Is a Breakout Around the Corner?

CoinsProbe·2025/03/06 10:55

Movement (MOVE) Gains Momentum as Trump’s World Liberty Accumulates – Is a Breakout on the Horizon?

CoinsProbe·2025/03/06 10:55

IMX and SAND Retest Key Breakouts – Is a Bounce Back Ahead?

CoinsProbe·2025/03/06 10:55

Bitcoin Jumps Above $92K as Trump Delays Tariffs on Canada and Mexico

Analysts see the tariff delay as a sign of economic stability, boosting investor confidence in risk assets like cryptocurrencies.

CryptoNews·2025/03/06 08:55

Research Report | Analysis of the Elixir Network Project & ELX Market Cap

远山洞见·2025/03/06 07:54

Flash

- 2025/03/12 23:58The support rate for the Solana SIMD-228 proposal currently stands at 35.7%, with an opposition rate of 17.2%News on March 13, according to on-chain data, the current support rate for Solana's SIMD-0228 proposal has reached 35.7%, with an opposition rate of 17.2% and an abstention rate of 1.2%. If the proposal is passed, it will be gradually implemented within 50 epochs, aiming to significantly reduce inflation (possibly by 70%-80%, for example from 4.5% down to a minimum of about 0.87%). The proposal suggests major adjustments to the token issuance model of the Solana blockchain. Specifically, it hopes to change SOL token's inflation mode from its current fixed rate to a dynamic market mechanism linked with staking participation rates. The aim is to optimize Solana's monetary policy by dynamically adjusting inflation rates based on SOL's staking ratio, thereby enhancing network economy flexibility and efficiency.

- 2025/03/12 23:41Overview of Key Overnight Developments on March 131. CBOE submits Solana ETF application for Franklin; 2. US SEC confirms receipt of Fidelity's Ethereum ETF staking proposal application; 3. US SEC confirms receipt of Franklin's Ethereum ETF staking proposal application; 4. US SEC delays approval of Fidelity's spot Ethereum ETF options trading again; 5. Fox reporter: US SEC's lawsuit against Ripple is in the final stages; 6. Massachusetts lawmakers propose the establishment of a special committee on blockchain and cryptocurrency; 7. BlockTower's venture capital division splits into Strobe Ventures and plans to raise $100 million.

- 2025/03/12 23:40AML Bitcoin founder convicted of fraud, could face decades in prisonNews on March 13, the San Francisco Federal Court jury of 12 ruled today that Marcus Rowland Andrade, the founder of Anti-Money Laundering Bitcoin (AML Bitcoin), orchestrated a "pump and dump" scam involving millions of dollars in 2017. He was found guilty of federal wire fraud and money laundering charges and could face decades in prison. Andrade is a businessman from Texas who once worked with well-known lobbyist Jack Abramoff to promote AML Bitcoin as a "safe and reliable" payment system.