News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 16) | U.S. Treasury Secretary calls high tariffs unsustainable; Public companies ramp up crypto holdings2SOL Strategies and Pudgy Penguins Launch PENGU Validator on Solana Network3Canada to launch spot Solana ETFs this week: report

Expert Says XRP Case Win Won’t Guarantee Price Surge—Here’s Why

CryptoNewsFlash·2025/04/15 22:22

FIL Price Forecast: Explosive Growth Likely After Filecoin (FIL) v1.32.2 Upgrade

CryptoNewsFlash·2025/04/15 22:22

SEC Pushes Back WisdomTree Bitcoin ETF Verdict to June

CryptoNewsFlash·2025/04/15 22:22

EURC Hits New Record as Demand Grows Across Blockchains

CryptoNewsFlash·2025/04/15 22:22

Second Day of BTC ETF Inflows Hints at Confidence Amid Volatility | ETF News

BTC ETFs experienced notable inflows, including BlackRock’s IBIT, signaling institutional optimism. Despite market setbacks, futures traders maintain a bullish outlook.

BeInCrypto·2025/04/15 22:21

XRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

Newsbtc·2025/04/15 20:55

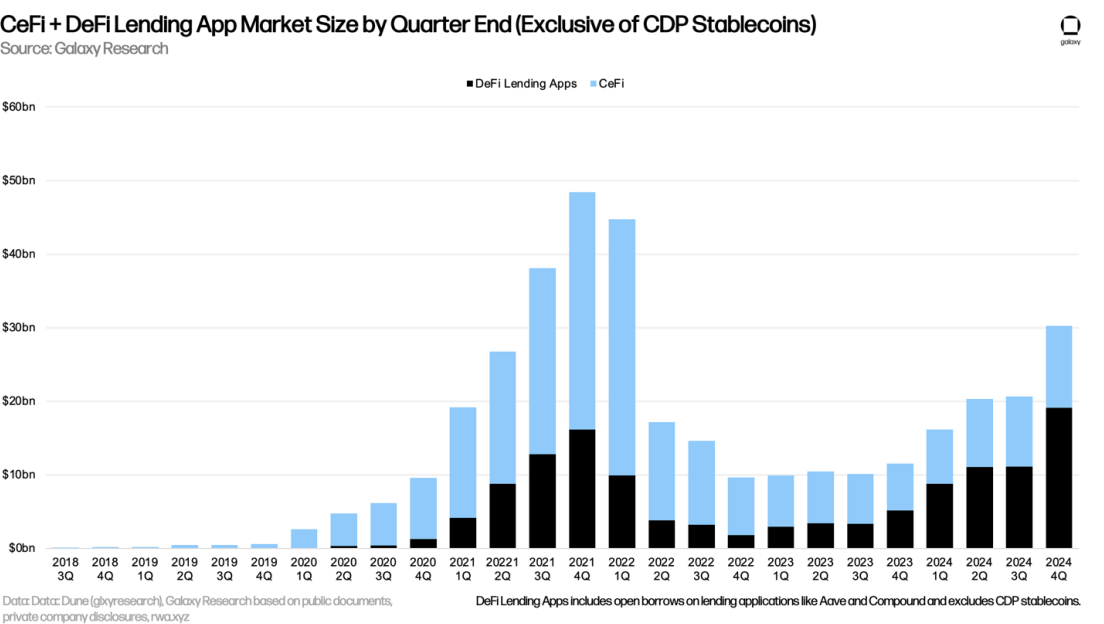

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

Blockworks·2025/04/15 17:23

Fed Chair Powell Indicates Possible Relaxation of Crypto Banking Regulations Amid Economic Caution

Coinotag·2025/04/15 16:00

Unlock Seamless Token Vesting with Sablier

The Block·2025/04/15 16:00

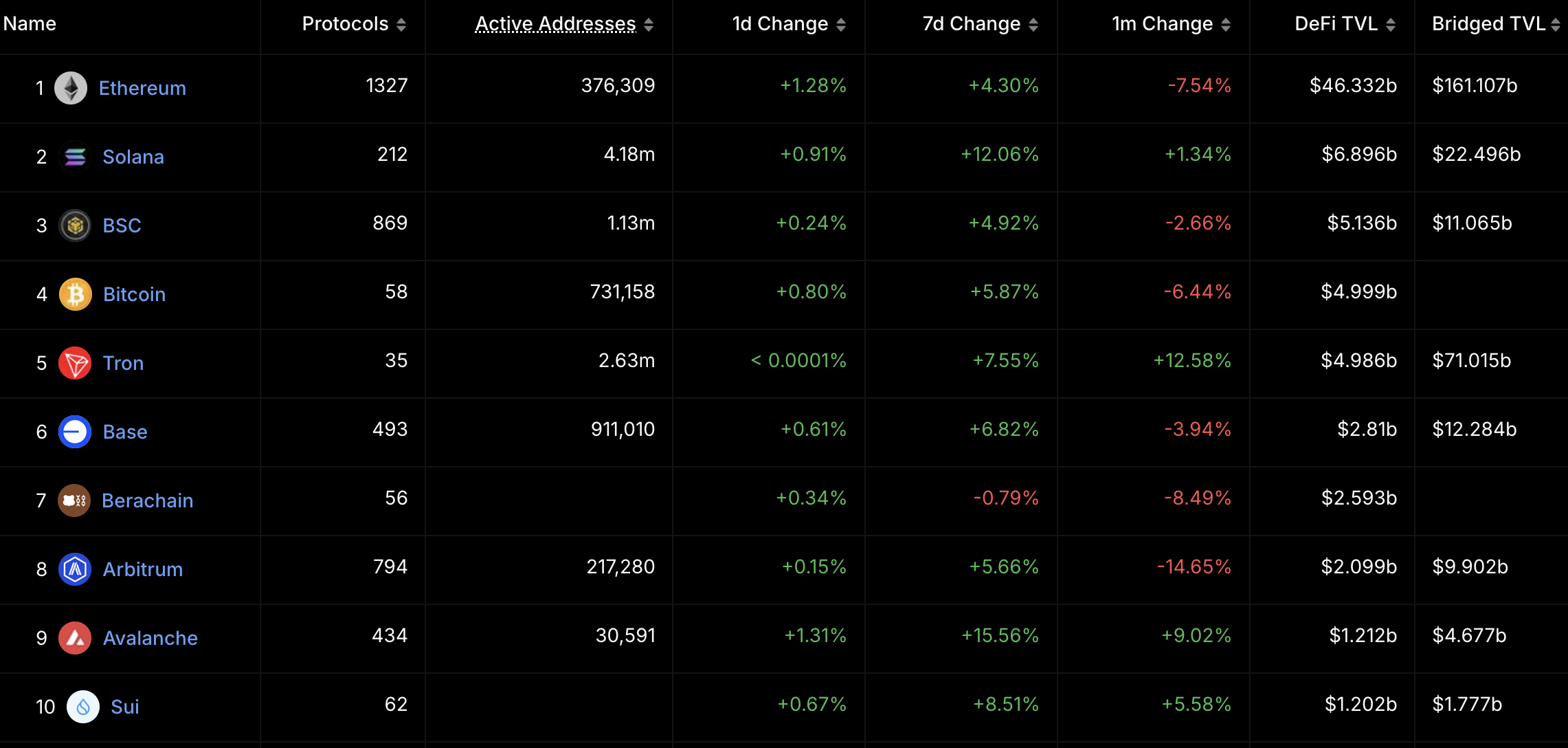

Ethereum Dominates Q1 2025 DApp Fee Revenue, Suggesting Continued Growth Amidst Strong Competition

Coinotag·2025/04/15 16:00

Flash

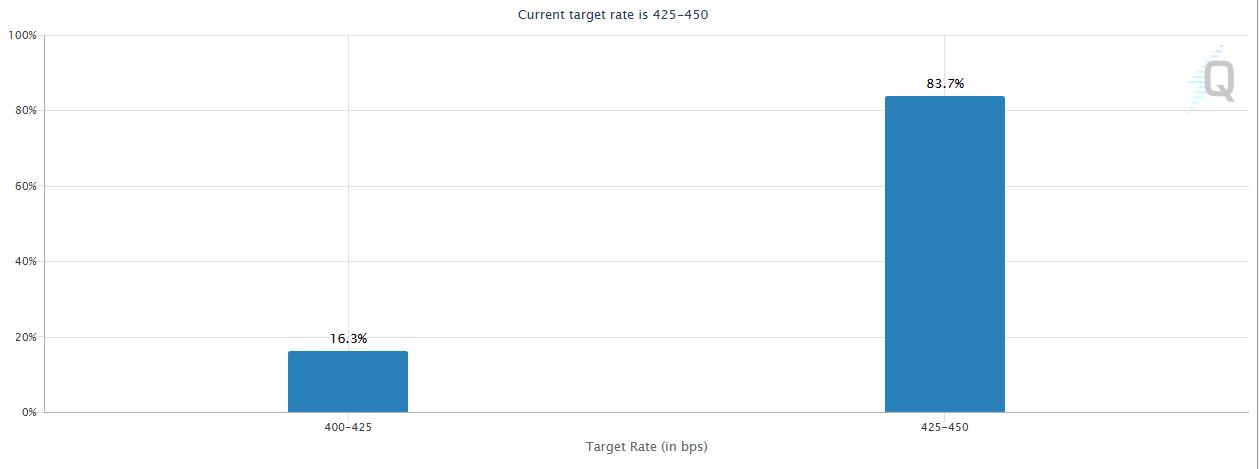

- 22:16The probability of the Fed keeping rates unchanged in May is 83.2%According to Jinse, as reported by CME "Fed Watch", the probability of the Federal Reserve keeping rates unchanged in May is 83.2%, while the probability of a 25 basis point rate cut is 16.8%. By June, the probability of the Fed keeping rates unchanged is 32.8%, the cumulative probability of a 25 basis point rate cut is 57.0%, and the cumulative probability of a 50 basis point rate cut is 10.2%.

- 22:16U.S. stock markets' three major indices closed sharply downThe three major indices of the U.S. stock market closed sharply down, with the NASDAQ falling 3.07%, the Dow Jones dropping 1.73%, and the S&P 500 Index declining 2.24%. Large technology stocks collectively fell, with Nvidia down over 6%, Tesla down over 4%, and Apple, Meta, and Microsoft down over 3%. Amazon and Google fell over 2%. Associated Tags U.S. stock markets' three major indices Dow Jones S&P 500 Index ChainCatcher reminds readers to approach the blockchain with a rational mindset and raise awareness of risks, being cautious of various virtual currency issuances and speculations. All content on the site is merely market information or opinions of related parties and does not constitute any form of investment advice. If any sensitive information is found on the site, you can click on "Report," and we will handle it promptly.

- 22:16Ethereum Fees Drop to Five-Year LowAccording to a report by Jinse, data from Santiment on the X platform indicates that Ethereum fees have dropped to the lowest level in five years, with the current transaction cost being just $0.168. This marks the lowest daily cost for ETH transfers since May 2, 2020.

Trending news

More