News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

10x Research’s Markus Thielen sees a “real possibility” of a lower CPI print in the US on Feb. 12, which could defy consensus expectations and trigger a Bitcoin rally.

HBAR's 10% drop fuels a surge in short positions, with technical indicators predicting more downside. If support at $0.20 breaks, further losses could follow.

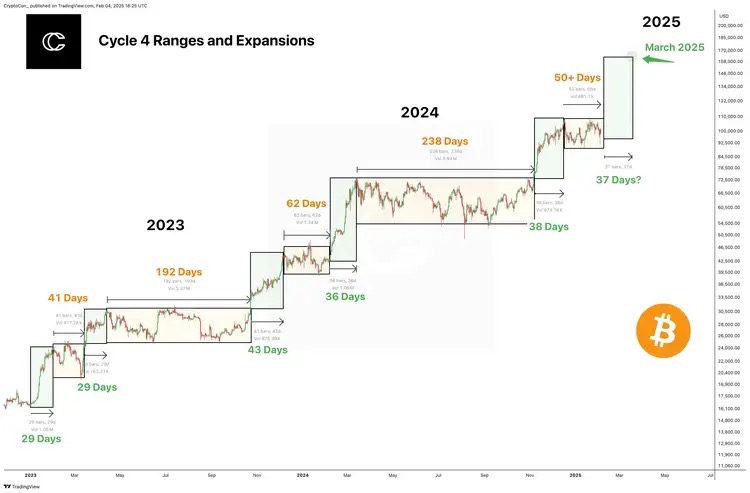

Bitcoin may be flagging on short timeframes, but there is plenty of belief in BTC price discovery returning as gold surges.

Pi Network’s upcoming Open Network launch has experts raising red flags over its pyramid-like structure and potential legal risks. Despite widespread growth, concerns about its legitimacy persist, especially in regulated regions.

Cardano's ADA initially surged after news of Grayscale's spot ETF filing, but the excitement quickly faded, with ADA dropping 4% as bearish sentiment takes hold.

- 04:17A certain address deposited 1.14 million USDC into Hyperliquid, using a 20x leverage to go long on BitcoinAccording to Lookonchain monitoring, during the Bitcoin price drop, some whales chose to buy against the trend and go long on BTC. The address 0x9b28...7cA1 deposited 1.14 million USDC into Hyperliquid to leverage Bitcoin by 20 times. Meanwhile, another address 0x8Bff...CDC3 invested $4 million and set up 100 limit orders to go long on Bitcoin in the price range of $76,000 to $79,000.

- 03:51Andre Cronje has created a new project, Flyingtulip, positioned as a high-leverage contract trading protocolNews on March 10th, Sonic (formerly Fantom) co-founder Andre Cronje (AC) has added the tag "flyingtulip founder" to his personal X profile. According to the official website of the project, flyingtulip is positioned as a new generation of intelligent trading protocol that can support more than 50 times leverage trading. The protocol uses adaptive curve technology, which can automatically adjust between constant product and constant sum curves according to real-time market volatility, providing traders with better execution prices while bringing optimal returns for liquidity providers.

- 03:47Market expectations suggest that the Federal Reserve may resume rate cuts as early as JuneIn light of Trump's chaotic tariff policy and federal government layoffs, bond traders are signaling an increasing risk of economic stagnation in the United States. Less than two months into Trump's presidency, there was speculation that he would inject stimulus measures to expand the US economy and continue to put upward pressure on US Treasury yields, but this speculation is quickly being discarded. Instead, traders have been buying short-term U.S. Treasuries in large quantities since mid-February, with a significant drop in two-year Treasury yields. The market expects the Federal Reserve may resume rate cuts as early as June to prevent economic deterioration.