News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

In the medium to long term, the negative impact will not always exist. The United States still has more than 6 trillion US dollars of monetary base waiting to be released, and the market sentiment will gradually become desensitized.

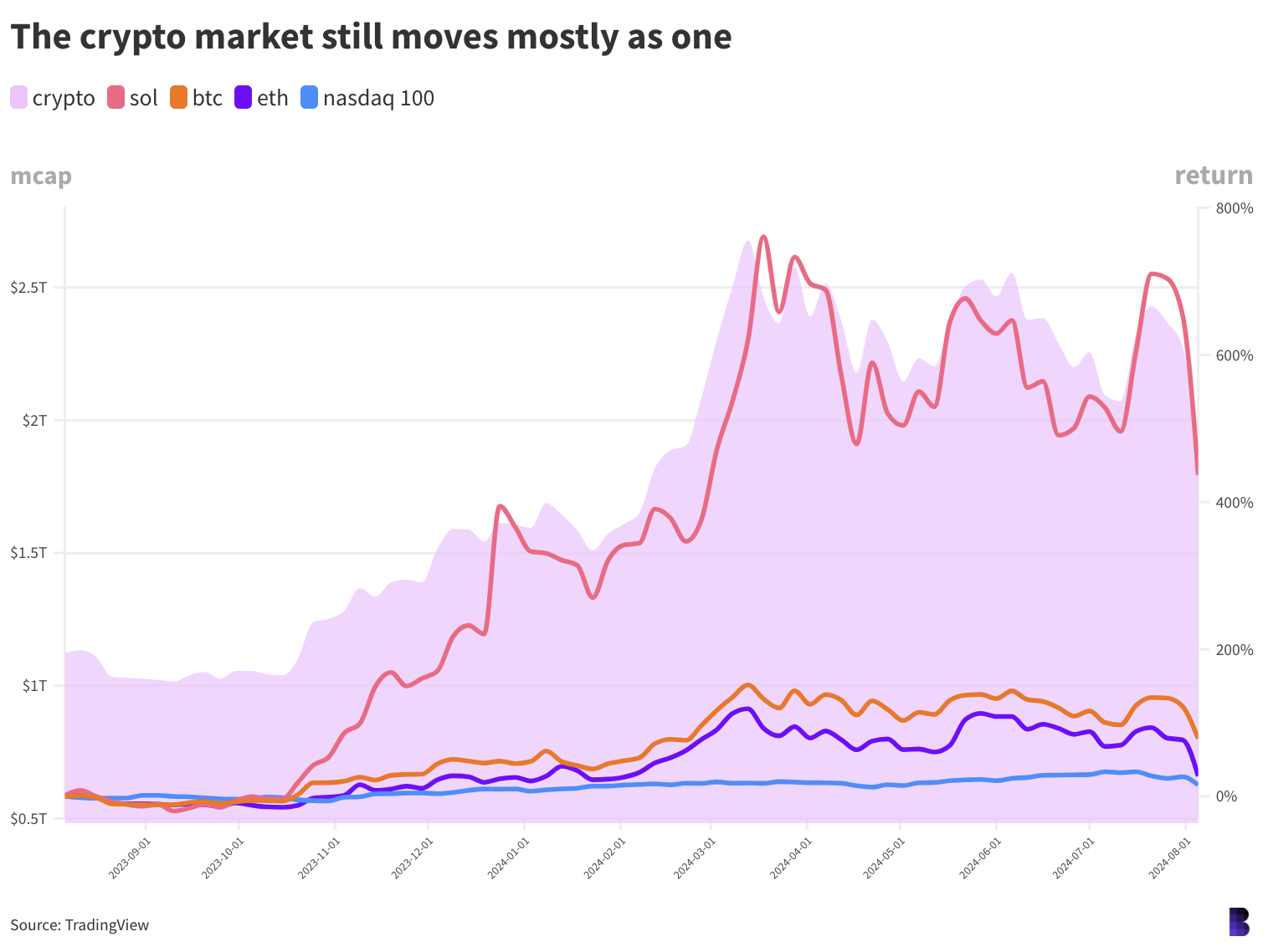

Bitcoin declined by a very similar amount following the halving in 2016 and before the 2017 bull run.

Arweave AO launches 10 new projects as it seeks to expand its vision of redefining on-chain computing.

Institutional Crypto Research Written by Experts

Plus, how many times a day are we checking markets?

In an environment where Bitcoin showed a sudden decline, the famous economist shared what he expected from now on and the critical price level.

Crypto stocks including bitcoin miners, Coinbase and MicroStrategy were all lower Monday morning

Jump Crypto is making major moves onchain — as it should with all this volatility

- 22:12ECB Support for Another Rate Cut in JuneThe European Central Bank (ECB) policymakers, in response to continued downward inflation, are increasingly confident of a rate cut in June, although it is not expected to be substantial. Last week, several ECB governors attended the International Monetary Fund (IMF) and World Bank Spring Meetings, discussing the potential negative impacts on the Eurozone and global economy due to U.S. tariffs. Additionally, the latest Eurozone economic data reflects this phenomenon. As for inflation, so far, there is no evidence of deterioration due to tariffs. Sources indicate that more ECB governors believe a successive eighth rate cut of 0.25% on June 4 is a more appropriate decision. The ECB will also release its latest economic forecast on the same day. However, ECB officials remain open-minded, awaiting next month's data before making a final decision.

- 22:11Poll: Trump's 100-Day Approval Rating Lowest Among U.S. Presidents in 80 YearsU.S. President Donald Trump's second term is approaching its 100th day. On April 27, local time, a new poll conducted by ABC News, The Washington Post, and Ipsos Group revealed that Trump's 100-day approval rating is 39%, a drop of 6 percentage points since February this year, marking the lowest 100-day approval rating of any U.S. president in the past 80 years. (CCTV News)

- 22:11Trump "Unilaterally Proclaims" Columbus Day Will Be Restored as a Federal HolidayOn Sunday, Trump stated that he plans to restore Columbus Day (the second Monday in October) as a federal holiday in the United States. However, a U.S. president cannot unilaterally cancel or declare a federal holiday; Congress approval is needed. Columbus Day remains a federal holiday, but as of last year, Indigenous Peoples' Day has replaced Columbus Day in over 200 cities and several states. Trump said on social media: "I will resurrect Columbus Day. Democrats are doing everything possible to destroy Christopher Columbus, his reputation, and all Italians who love him." Christopher Columbus was a renowned medieval to modern European navigator, explorer, and colonizer. According to foreign media, many oppose the celebration of Columbus Day due to his colonial history and the torture and genocide of indigenous peoples. Indigenous Peoples' Day began in the 1990s and has gained momentum since, including in 2021 when Biden became the first president to formally recognize the holiday with a proclamation.