News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

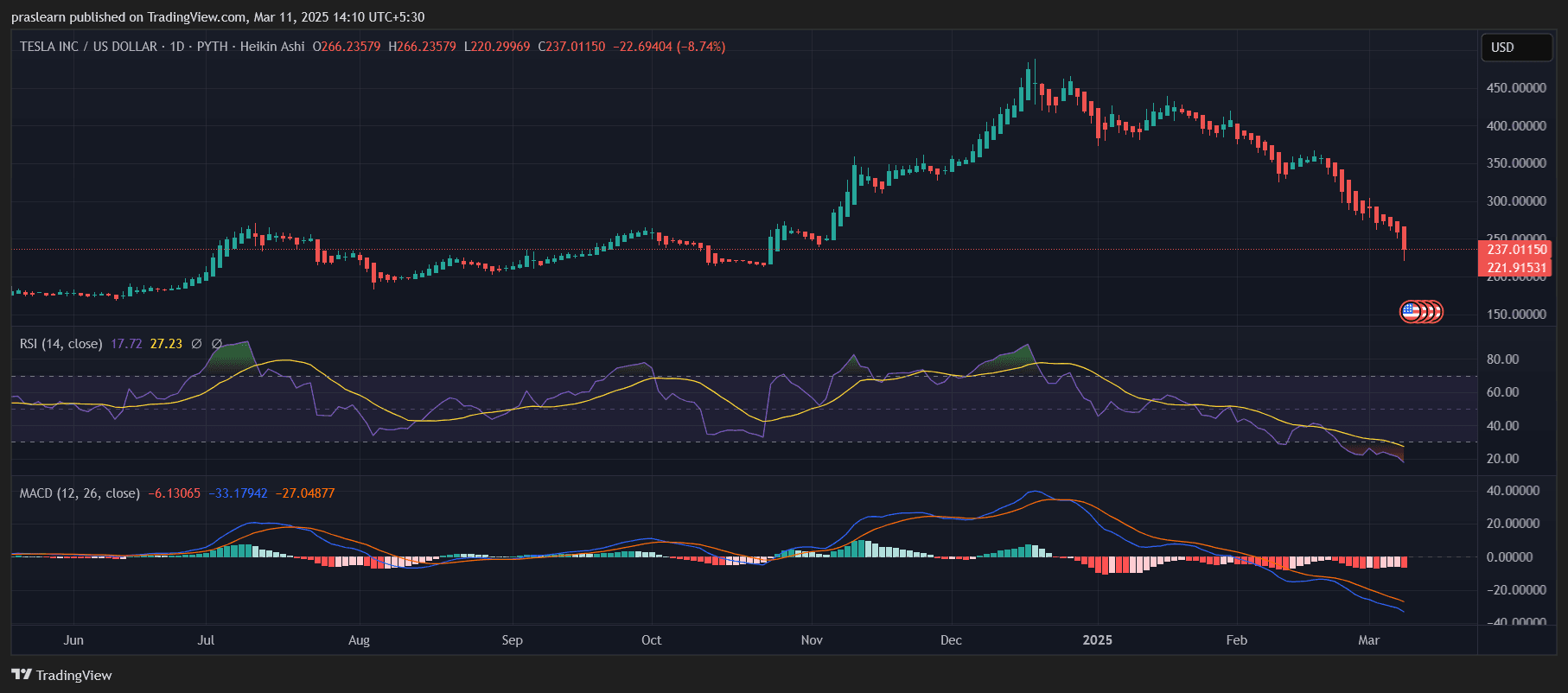

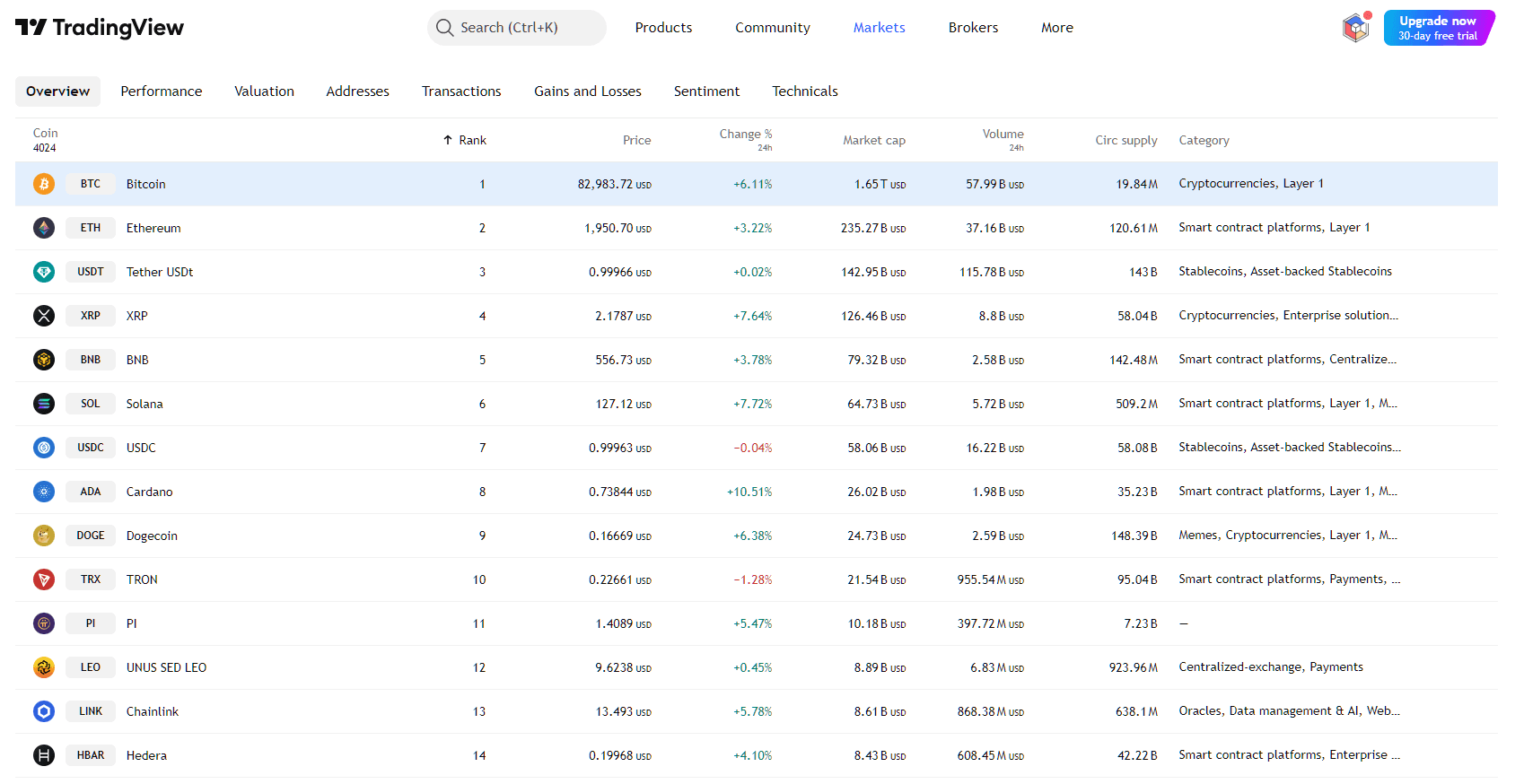

The market selloff is heavily tied to the increased correlation between equities and crypto, as crypto-friendly institutions are going more risk-off

Amid market headwinds, a major asset manager unveils a fresh investment path centered on Avalanche, hinting at renewed institutional confidence in evolving blockchain solutions.

In January 2024, Taproot Wizards launched the popular Ordinals collection called Quantum Cats, which sold out in a matter of minutes.

Pi Network has extended the KYC deadline on numerous occasions, with some users complaining that their tokens still haven't shown up as verified.

March 1 saw the FTX estate release more than 9 million SOL into the market, although recipients may not necessarily sell their coins at once.

Texas is exploring a bold fiscal pivot by weighing digital asset integration to refresh state reserves and modernize investment strategies amid shifting economic landscapes.

- 07:42Analysis: The spread of Bitcoin CME futures narrows to 490 US dollars, Trump effect fadesAccording to CoinDesk, data from the Chicago Mercantile Exchange (CME) Bitcoin futures market shows that bullish sentiment following Trump's election victory has completely faded. The price difference between CME Bitcoin "continuous" next month and near-month standard futures has narrowed to $495, dropping to its lowest level since November 5th, significantly down from the peak of $1,705 on December 17th. Thomas Erdösi, product manager at CF Benchmarks said: The narrowing of the price spread between CME Bitcoin near-month and next-month futures indicates traders are adjusting their price expectations. Since early March, the basis for near-term contracts has been significantly reduced, indicating that the market has fully digested Trump's election as a major catalyst previously driving market growth. Analysis suggests that markets may have abandoned narratives like "a pro-cryptocurrency president is beneficial for industry", with macro correlations re-emerging as dominant factors in the market. Despite this narrowing spread, CME future curves remain in contango state suggesting recent market adjustments are primarily driven by non-leveraged spot longs being squeezed out of the market rather than broader contagion.

- 07:16A smart money address spent 4.43 ETH to buy 1.92 billion DRB, achieving a return rate of 5243%According to @ai_9684xtpa's monitoring, a smart money address (mushroomgirl.eth) made nearly $510,000 in unrealized gains through DRB transactions, with a return rate of 5243%. Four days ago, when the market value of DRB was $500,000 - just one hour after going live - this address spent 4.43 ETH (about $9,719) to buy 19.2 billion tokens at an approximate cost of $0.000005029 each. This morning when the market value broke through $40 million dollars, its unrealized gain reached as high as $795,000 but there has never been any selling activity from this address.

- 07:14A certain whale added 3.485 million USDC as margin, reopening a 50x leveraged ETH long position againAccording to Auntie Ai's monitoring, the "Hyperliquid 50x Leverage Profit Whale" has once again opened a 50x ETH long position. This whale deposited 3.485 million USDC into their account as margin just 2 minutes ago. The current position of this whale has increased to 21,790.74 ETH, with the value of the position rising to $40.85 million USD.