News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.17) | Powell says Fed won't act without clear signals, California sues Trump over tariffs2KAITO Price Prediction 2025-35: Will It Hit $100 by 2035?3Are TRUMP Holders Selling the Meme Coin Ahead of Friday’s Token Unlock?

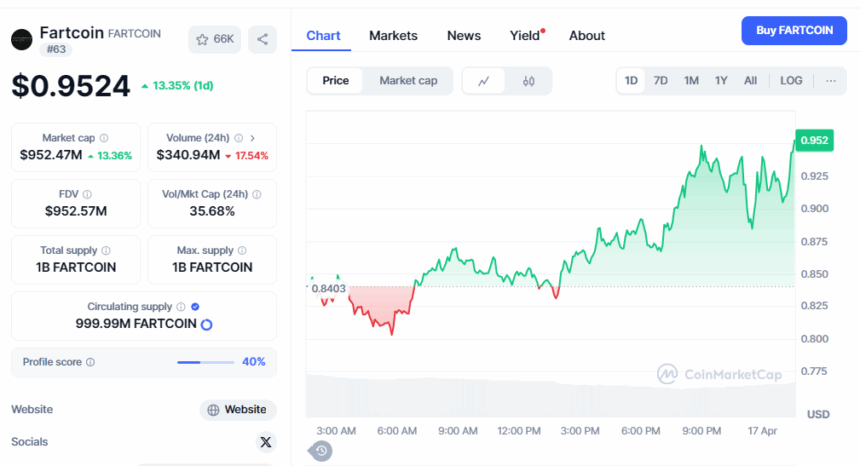

Fartcoin Soars After Breakout: What Investors Need to Know

In Brief Fartcoin experiences a significant breakout with increased trading volume. A newly created wallet purchases over 1 million FARTCOIN, signaling bullish interest. Investors see price movements as opportunities for potential gains.

Cointurk·2025/04/17 14:34

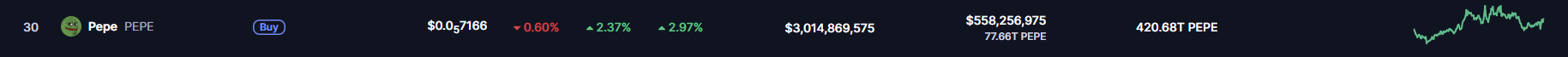

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Cryptoticker·2025/04/17 11:00

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CoinsProbe·2025/04/17 07:55

CORE Approaches Key Resistance – Could Breakout Spark a Recovery?

CoinsProbe·2025/04/17 07:55

Is Render (RENDER) Gearing Up For Another Breakout Rally? This Fractal Says Yes!

CoinsProbe·2025/04/17 07:55

Uniswap (UNI) Testing Key Support – Could This Pattern Spark a Reversal?

CoinsProbe·2025/04/17 07:55

Crypto in a bear market, rebound likely in Q3

Coinbase reports a shrinking crypto market and bearish signals but expects a potential rebound later in 2025.

Cointelegraph·2025/04/17 01:56

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Cryptotimes·2025/04/16 21:22

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Cryptonewsland·2025/04/16 20:55

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Cryptonewsland·2025/04/16 20:55

Flash

- 15:48The US Treasury Secretary warns that replacing Powell could lead to market instabilityPolitico White House reporter Megan Messerly wrote that U.S. Treasury Secretary Bessent privately warned that replacing Federal Reserve Chairman Powell could lead to market instability. According to reports, Trump also realized this, so despite his renewed dissatisfaction with Powell, according to Messerly, Powell's position seems safe for now. Powell has always said he will not resign and others have said Trump does not have the power to dismiss him.

- 15:43Notice: U.S. and European Markets Closed Tomorrow, Trading in Gold, Silver, Oil, and Forex SuspendedOn April 17th, due to the Good Friday and Easter holidays, U.S., Hong Kong, European, and Australian stock markets will be closed for one day on April 18th. Hong Kong, European, and Australian stock markets will remain closed on April 21st. Trading of CME's precious metals, U.S. crude oil, forex, agricultural products, and stock index futures contracts, as well as ICE's agricultural products and Brent crude oil futures contracts, will be suspended all day on April 18th and resume on April 21st. Investors, please take note.

- 15:43Blockworks Research: Hyperliquid's average daily trading volume reached $6.4 billion in the past 3 monthsThe report released by Blockworks Research shows that in the past three months, Hyperliquid's average daily trading volume reached $6.4 billion. In comparison, its closest competitor, Jupiter Perps, had an average daily trading volume of only $704 million, which is 88% lower than Hyperliquid. Additionally, the report notes that Hyperliquid's core businesses are HyperCore (order book trading) and HyperEVM (Ethereum Virtual Machine network), with HyperCore currently dominating.