AI Sector Tokens See Strong Price Recovery, Projects Like Moby and Orbit Worthy of Attention | AI Daily

The market is transitioning towards a more efficient infrastructure and innovative applications.

Original Author: S4mmyEth, Moca Network Researcher

Original Translation: zhouzhou, BlockBeats

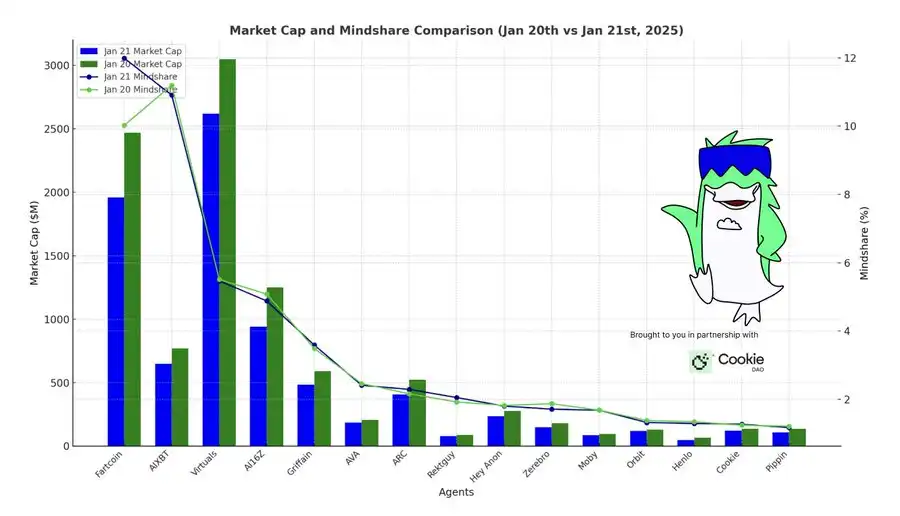

Editor's Note: The AI Agent market is currently experiencing a mix of profit-taking and rebound, with Fartcoin taking a lead in mindshare and market cap through the Meme effect. Foundational players like Virtuals, AIXBT, and AI16Z are steadily progressing, while emerging projects like Moby and Orbit are also gaining attention. DeFAI automation and infrastructure have become key trends. The market is experiencing a general pullback, with capital rotating between meme-driven and utility-driven agents. Increased developer participation, accelerated partnerships and technical integrations are driving the development of the AI Agent industry. Overall, the market is transitioning towards more efficient infrastructure and innovative applications.

The following is the original content (lightly rephrased for better readability):

Quotes:

「The market cap of the AI Agent market will reach $1 trillion, I have no doubt about this.」 — osf rekt

「Virtuals are the economic layer of AI Agents.」 — VaderResearch

「Search was the UI of the web, and since AI is eating UI, AI will eat search.」 — naval

「'I don't need an AI Agent' — This statement is usually the last thing said before being left behind by competitors.」 — dolion ai

Highlights:

The AI Agent market is facing a scenario of profit-taking and rebound. Fartcoin has dominated the discussion, rapidly rising in mindshare and market cap thanks to speculative retail and traditional financial investor influx. Meanwhile, foundational players like Virtuals, AIXBT, and AI16Z are steadily progressing amidst the market adjustments.

Emerging projects like Moby and Orbit continue to garner attention, while established DeFAI startups like HeyAnon/GriffAin are also experiencing growth in on-chain narratives.

Some of the standout projects include:

1. Fartcoin: Continuing its upward trend due to the Meme effect, despite a 20% price pullback after achieving over 100% returns in the past 72 hours, it still maintains its lead in market cap.

2. AIXBT: As a leader in the analysis domain stabilizes, it faces challenges of declining Mindshare and a slight market cap adjustment.

3. Virtuals: Maintaining a strong position in the Agentic infrastructure, benefiting from SDK integration and ecosystem development.

4. Moby: Consolidating its position as a whale monitor and infrastructure data proxy, attracting developer attention.

5. ARC and Griffain: Both demonstrating strong developer engagement and resilience in the emerging AI framework.

Individual Agent Analysis:

1. Fartcoin

Mindshare: 11.99% (+1.97%)

Market Cap: $19.6 Billion (-20.6%)

Comment: Fartcoin has successfully climbed to the top of Mindshare rankings by leveraging speculative market sentiment. Despite a 20% pullback after a sharp rise from $10 billion to $25 billion, its market hype remains strong.

“Hot air is on the rise.” — TaikiMaeda2

2. AIXBT

Mindshare: 10.91% (-0.29%)

Market Cap: $6.5 Billion (-15.5%)

Comment: Despite facing declines in both metrics, AIXBT remains a leader in analysis infrastructure, with recent focuses on refining its tokenomics and expanding ecosystem integration.

3. Virtuals

Mindshare: 5.47% (-0.04%)

Market Cap: $26.2 Billion (-15.6%)

Comment: Despite a decrease in market cap, Virtuals' dominant position in the Agentic infrastructure remains strong, aligning with the overall trend of market pullback.

Through GAME SDK integration and collaboration with key ecosystems, Virtuals has promoted the proliferation of its tech stack, rapidly becoming the economic layer of the future of Agentic:

“Build with any proxy framework you desire, just like religious freedom, that is the core value of Virtuals society.” — Virtuals

4. AI16Z

Mindshare: 4.88% (-0.2%)

Market Cap: $9.41 Billion (-6.3%)

Comment: AI16Z faces pullbacks in Mindshare and market cap but remains a favorite among developers, especially widely integrated across multiple chains and real-world applications.

Recent developments include Virtuals API integration (Issue 2552), boosting the future framework adoption by powering synergistic Agentic alternative infrastructures.

5.Griffain

Mindshare: 3.59% (+0.1%)

Market Cap: $4.84 billion (-4.7%)

Commentary: Griffain's modular tools have been gaining increasing attention, with new partnerships and updates highlighting its practicality.

"A new era of labor is coming... agents will drive robots to complete tasks for businesses and consumers." — tonyplasencia3

Despite a slight market cap adjustment, Griffain's developer activity remains strong.

6.AVA

Mindshare: 2.41% (-0.05%)

Market Cap: $1.84 billion (-11.4%)

Commentary: AVA's continued adoption in cross-chain applications has demonstrated its resilience, especially with the integration based on Solana driving engagement, particularly with staking nearing 20%.

7.ARC

Mindshare: 2.29% (+0.13%)

Market Cap: $4.08 billion (+3.3%)

Commentary: ARC continues to strengthen its framework product, enhancing its ecosystem influence through GitHub activity and new developer tools.

Partnerships are deepening, with an announcement of collaboration with $listen enabled.

"AI completing tasks is not through mechanical repetition, but through behavior patterns that reflect and extend human capabilities." — ARC

8.Rektguy

Mindshare: 2.05% (-0.1%)

Market Cap: $78.55 million (-9.9%)

Commentary: Rektguy's Meme community maintains a stable engagement, although profit-taking has led to a market cap decline, aligning with the overall market pullback.

Rektguy can now create OSF-style artwork and can validate its thought process through the terminal:

"You can view the agent's thought process and decision-making in our terminal." — osf rekt

Emerging Trends:

Meme Resilience: Fartcoin's continued growth in Mindshare has reinforced the narrative power of Meme-driven assets, despite experiencing a 20% retracement.

DeFAI Expansion: Moby, Hey Anon, and Orbit have highlighted the growing interest in DeFAI automation and infrastructure.

Infrastructure Leadership: Virtuals, AI16Z, Griffain, Pippin, and ARC are driving developer engagement through scalable AI solutions.

Profit-Taking and Capital Rotation: The widespread market correction indicates capital rotation between Meme and utility-driven agents.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Sees Nearly $100M Outflow After Trump’s Tariff News

Crypto Price Today (April 4, 2025): Bitcoin Visits $81k Low, Altcoins See Drastic Drop

Bitcoin Power, $MSTR Rises While U.S. Stock Market Crash!

ATOM at a Crossroads: Will Breaking $5.20 Trigger a 50% Rally or Another Rejection?