Will Bitcoin (BTC) See a V-Shaped Recovery? Historical Pattern Hints at Reversal

Date: Thu, March 13, 2025 | 01:48 PM GMT

The cryptocurrency market has faced a sharp correction, with major assets experiencing significant pullbacks after their explosive rallies in late 2024. Bitcoin (BTC), which had reached a new all-time high of $109,000 on January 20, has since retraced to a low of $76,000 before jumping around $82,000 at the time of writing.

While this drop has caused fear among investors, historical price action suggests that a strong V-shaped recovery could be on the horizon.

Bitcoin (BTC) Mirrors the Feb-May 2021 Trend

According to the latest analysis by prominent crypto analyst Alex Clay , Bitcoin’s current price structure bears a striking resemblance to its market behavior in early 2021. Back then, Bitcoin experienced a parabolic rally, reaching its then all-time high of $64,000 in April 2021. However, instead of continuing its upward momentum, BTC entered a distribution phase, where price movement became choppy and range-bound.

During this period, Bitcoin traded within a tight range, repeatedly testing resistance levels before eventually breaking down. The market then experienced a steep correction, with BTC plunging nearly 50% in just a few weeks, hitting lows around $30,000 in May 2021. However, what followed was a textbook V-shaped recovery, where Bitcoin rebounded sharply, regaining bullish momentum and eventually reaching a new all-time high of $69,000 by November 2021.

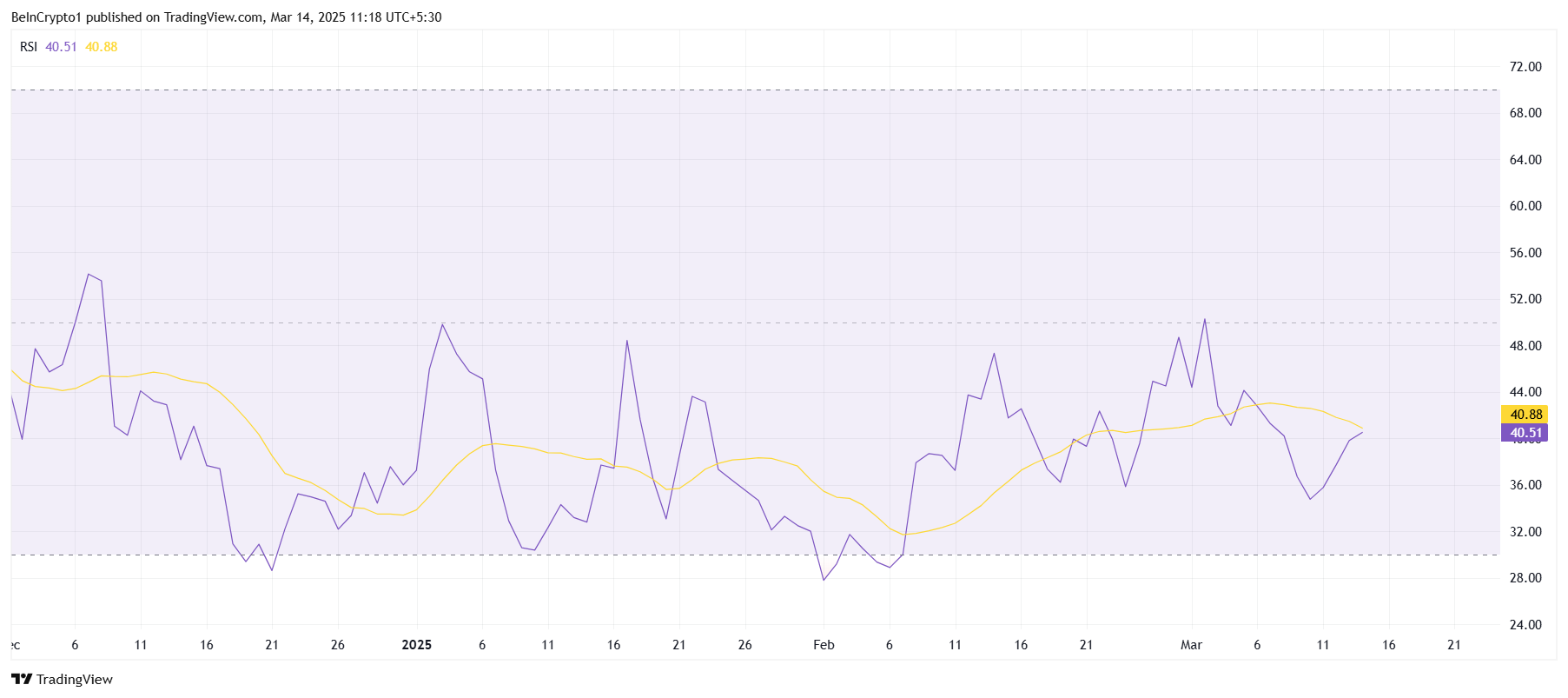

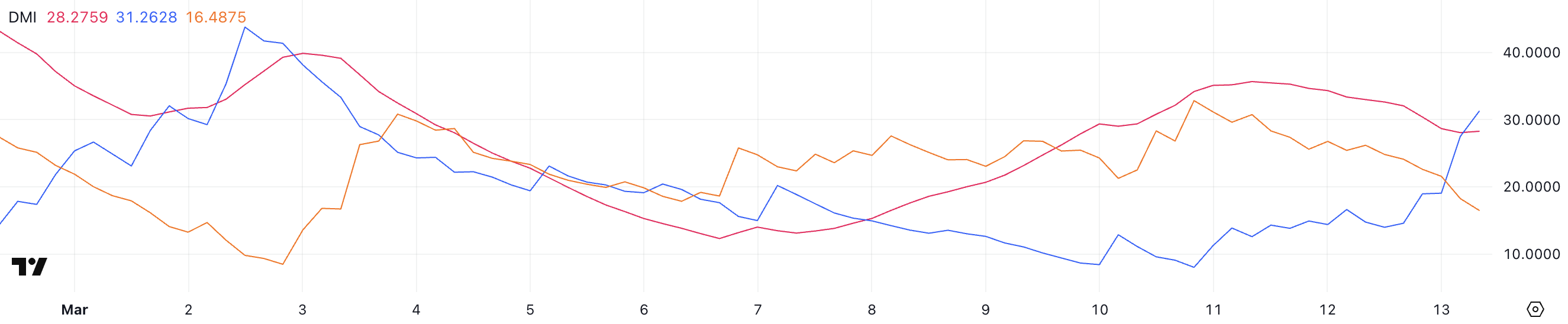

Fast forward to 2025, and a similar pattern is playing out. Bitcoin recently saw a distribution phase around the $100K mark, where the price remained range-bound for weeks before breaking down. This led to a rapid sell-off, with BTC dipping to $76K before bouncing back to the $81K–$83K level.

Just as in 2021, this sharp drop is now being followed by signs of a potential recovery. Analysts suggest that if Bitcoin can reclaim key resistance levels in the coming weeks, the current structure could lead to yet another V-shaped rebound, potentially pushing BTC back toward $100K and beyond.

What’s Next for BTC?

If Bitcoin follows the historical 2021 pattern, a strong bullish V-recovery could be in play, potentially pushing prices back into the $95K–$100K zone in the coming weeks. If bullish momentum accelerates, BTC could attempt a new all-time high beyond $110K.

However, investors should remain cautious—while historical patterns provide valuable insights, market conditions in 2025 remain unpredictable, with macroeconomic factors playing a crucial role in Bitcoin’s next move.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making any investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Daily Digest (March 14) | Putin agrees to 30-day ceasefire, Base ecosystem gains attention with AI narratives

Stellar (XLM) Seeks Momentum for Breakout as Key Resistance at $0.309 Approaches

Cardano (ADA) May Be Approaching a Key Price Turning Point Amid Weakening Downtrend

POPCAT Faces Consolidation Challenges Amid Weak Investor Sentiment and Resistance at $0.203