SUI Gains Traction as Canary Capital Files for ETF – Is a Breakout Ahead?

Date: Tue, March 18, 2025 | 03:45 AM GMT

The layer-1 blockchain project Sui (SUI) is gaining significant traction this month, fueled by major developments in both institutional adoption and ETF-related filings. First, Trump-backed World Liberty Financial (WLFI) announced the addition of SUI to its strategic reserve, marking a notable step toward mainstream adoption. Following this, Canary Capital officially submitted an S-1 filing with the SEC for a SUI exchange-traded fund (ETF), further driving interest in the asset.

These bullish catalysts have helped SUI recover from its recent downtrend, posting a 10% weekly gains, after facing a 90-day correction. With this momentum building, technical indicators are now hinting at a potential breakout in the near future.

Source: Coinmarketcap

Source: Coinmarketcap

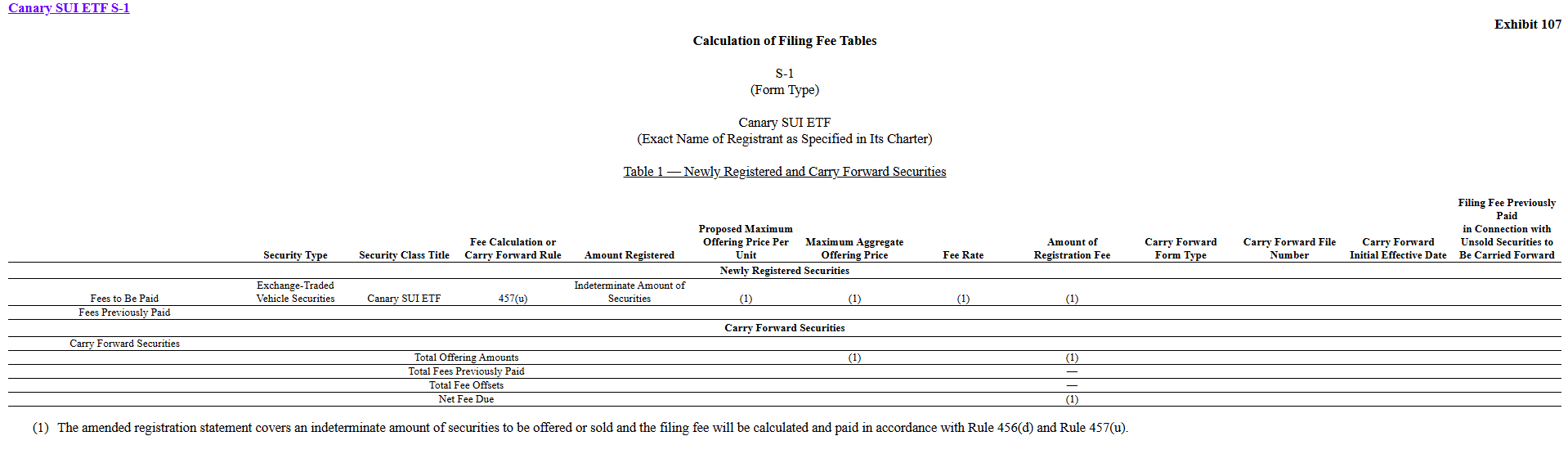

Canary Capital Files S-1 With SEC for SUI ETF

Canary Capital filed an S-1 registration statement with the U.S. SEC on Monday, March 17, 2025, for a spot ETF tracking SUI, the native token of the Sui Network. The proposed fund aims to provide investors with regulated exposure to SUI’s price movements without requiring direct ownership of the cryptocurrency, marking a potential milestone for institutional adoption of the Layer-1 blockchain asset.

Source: sec.gov

Source: sec.gov

The filing follows Canary Capital’s registration of a statutory trust in Delaware on March 6, a procedural step commonly undertaken before SEC submissions to establish the fund’s legal framework. To complete the listing process, the firm must still submit a 19b-4 filing through its chosen exchange—such as Nasdaq or NYSE—pending SEC approval.

This development, coupled with SUI’s recent inclusion in World Liberty Financial’s reserves, underscores growing institutional confidence, driving a 10% price surge this week.

Is a Breakout Ahead?

From a technical analysis standpoint, SUI is at a crucial inflection point. After bouncing from its recent low of $1.97, the token has now reclaimed the $2.34 level, which also marks its demand zone. This price action brings it closer to breaking out of a falling wedge pattern, a structure that historically signals potential bullish reversals.

SUI Daily Chart/Coinsprobe (Source: Tradingview)

SUI Daily Chart/Coinsprobe (Source: Tradingview)

SUI is now approaching the upper resistance of the falling wedge, a level that, if breached, could trigger a strong rally. The next major hurdle of resistance is at $3.00, which aligns with the 50-day moving average (50MA) and 200-day MA. A successful breakout above this zone could lead to a 26% upside from current levels.

The MACD indicator is also showing early signs of a bullish crossover, indicating that buying momentum is building. If this trend continues and SUI confirms a breakout with a retest of previous resistance as support, a new uptrend could emerge.

However, if the breakout attempt fails, SUI may retest lower support levels before making another move to the upside.

Final Thoughts

With both the ETF narrative gaining traction and the strategic partnership with WLFI, SUI is positioning itself for major growth. The Canary Capital ETF filing could pave the way for institutional capital inflows, while the World Liberty Financial partnership enhances its role in the DeFi ecosystem.

If these fundamental catalysts align with a technical breakout, SUI could experience a significant rally, further solidifying its standing in the blockchain space.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Social Sentiments Hits Highest Bullish Level in 4 Months, Will Prices Follow?

Research Report | Tutorial Project Analysis & TUT Market Valuation

Bitcoin price volatility ramps up around FOMC days — Will this time be different?

Bitcoin traders tend to cut risk leading into FOMC meetings, but key price metrics are showing a divergence. Will BTC rally when the Fed minutes are released?

EOS rebrands to Vaulta for $4.1B Web3 banking push