Canary Capital files for first-ever Pengu ETF amid expanded crypto offerings

Quick Take Canary Capital filed for that ETF in a registration statement to the SEC posted on Thursday. Firms have been looking to get the SEC’s sign-off for several different types of crypto ETFs ranging from ones tracking SOL and XRP to DOGE — and now Pengu.

Canary Capital has filed for what would be the first exchange-traded fund of its kind — a Pengu ETF — as firms forge on to see what might stick for the U.S. Securities and Exchange Commission.

The institutional crypto trading and management firm filed for that ETF in a registration statement to the SEC posted on Thursday. The fund will hold the NFT along with other cryptocurrencies, the firm said. The Ethereum-based NFT project Pudgy Penguins launched the PENGU token in December.

"In seeking to achieve its investment objective, the Trust will invest in a portfolio consisting primarily of (1) PENGU, the official token on the Pudgy Penguins project, and (2) Pudgy Penguins non-fungible tokens ('NFTs'), according to the filing. "The Trust will also hold other digital assets, such as SOL and ETH, that are necessary or incidental to the purchase, sale and transfer of the Trust’s PENGU and Pudgy Penguins NFTs."

Canary is vying for several altcoin ETFs, including one to track Sui , as well as others for Hedera and Litecoin , among others.

Over the past few months, firms have been looking to get the SEC's sign-off for several different types of crypto ETFs ranging from ones tracking SOL and XRP to DOGE and now Pengu.

Under the previous administration, the SEC approved the listing of spot Bitcoin ETFs in January 2024 and spot Ethereum ETFs in July. However, the agency has signaled a more friendly approach to the industry, such as dropping enforcement actions against major crypto industry players and creating a crypto task force to work out how to regulate the industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

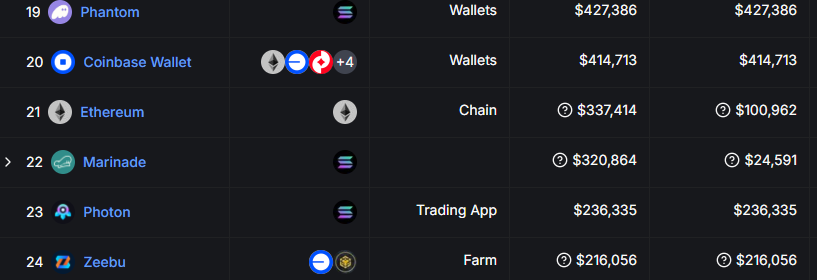

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.