Bitcoin-focused Metaplanet appoints Eric Trump to advisory board

Quick Take Japan’s Metaplanet announced today that it has appointed Eric Trump to join its Strategic Board of Advisors. The company is currently the world’s 10th largest corporate owner of bitcoin, with 3,200 BTC.

Japan's Metaplanet announced today that it has appointed Eric Trump to join its Strategic Board of Advisors.

Trump, the second son of the U.S. President, will assist the company in advancing its mission to expand its bitcoin treasury, Metaplanet CEO Simon Gerovich said on X.

"Eric Trump brings a wealth of experience in real estate, finance, brand development, and strategic business growth and has become a leading voice and advocate of digital asset adoption worldwide," Metaplanet said.

The Tokyo-listed company announced its bitcoin accumulation strategy last year and has set a goal of accumulating 10,000 BTC by the end of 2025. With its most recent purchase of 150 BTC on Tuesday, the company currently holds 3,200 BTC.

This makes the company the world's 10th largest corporate bitcoin holder, while Michael Saylor's Strategy remains in the top place with close to 500,000 BTC, according to BitcoinTreasuries.net .

Meanwhile, Eric is also an ambassador for the crypto project World Liberty Financial alongside Donald Jr. and Barron Trump, while the U.S. President is listed on the project website as "chief crypto advocate." However, the project's white paper states that the Trump family members are not involved in running or owning the WLFI project.

According to Google Finance data , Metaplanet stocks gained 1.3% to $27.80 during Friday trading hours in Japan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

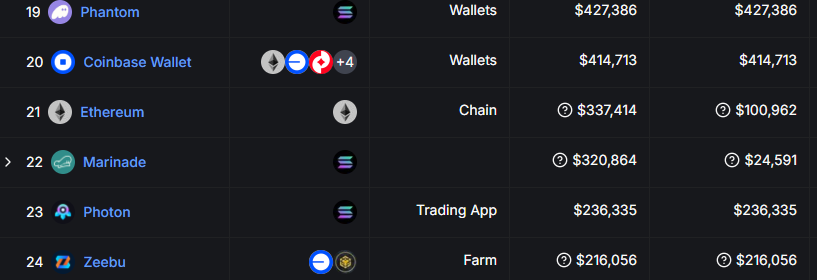

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.