Ethereum Exchange Reserves Drop Below 19M: Key Support and Resistance Levels to Watch

- Ethereum exchange reserves fall below 19M, reflecting reduced liquidity and potential price volatility.

- Big owners of ETH transfer off the exchanges, tightening supply and driving long-term accumulation trends.

- Ethereum faces key resistance at $3K, with dwindling reserves shaping a potential breakout or extended correction.

Ethereum’s exchange reserves continue to decline as market movements indicate shifting dynamics. The asset’s price fluctuations align with reserve depletion, reflecting ongoing market activity and potential supply constraints.

Exchange Reserves and Price Movements

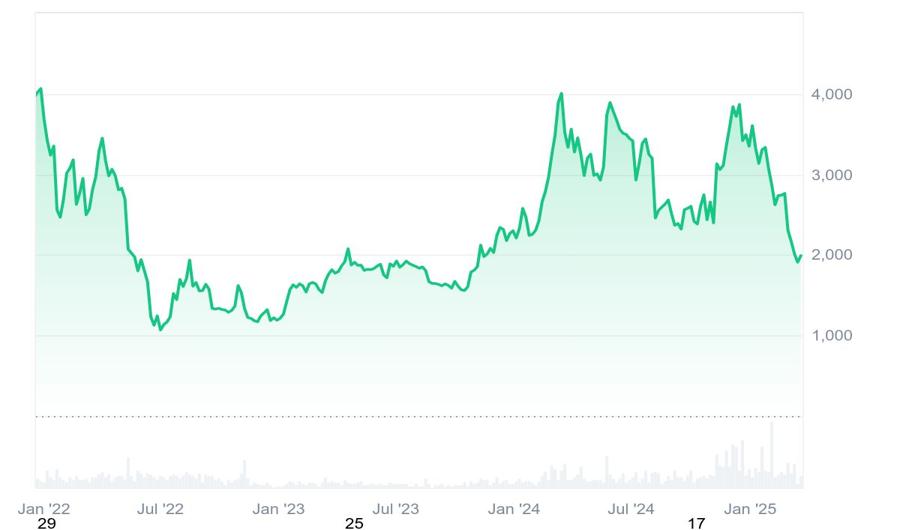

Ethereum reserves on the exchange have tracked a steady downtrend from the mid-2022 period at more than 28 million. In 2023, the downtrend intensified such that reserves dropped to around 22 million during the start of 2023. Ethereum price was not more stable, however, with bursts of bullish vigor and correction.

Source: CoinMarketCap

Tracking Ethereum price movement, by mid-2024, the price surged past $3,000 and briefly traded above $4,000 before a sharp pullback occurred. Exchange reserve balances continued to decline during this period, to a level of around 20 million. The fourth quarter of 2024 saw reserves briefly reversing with a minor spike. However, the surge proved to be short-lived as reserves began to run low in the early part of 2025.

The market today views a bear correction since Ethereum prices plummeted rapidly to levels of about $1,900 in early 2025. With declining supplies on exchanges, potential supply constraints will influence future prices and will stimulate increased volatility.

Market Liquidity and Supply Constraints

According to prominent analyst Ted Pillow, Ethereum’s shrinking exchange reserves indicate an ongoing accumulation phase. Pillow notes that large holders are likely withdrawing ETH from exchanges, signaling long-term investment strategies. This movement reduces available liquidity, increasing the likelihood of heightened price competition.

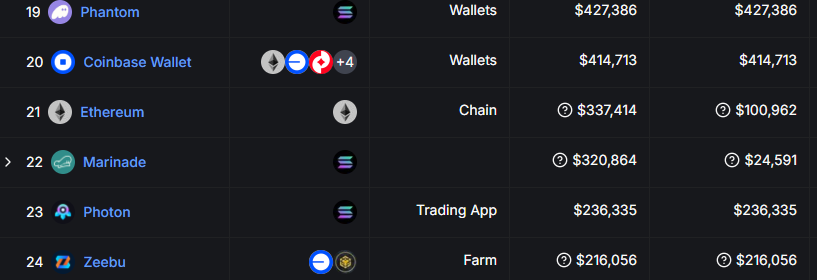

Source: Ted Pillow

A detailed breakdown from Pillow explains that Ethereum’s price trajectory has historically correlated with exchange reserves. When reserves fall significantly, upward price movements tend to follow due to reduced sell pressure. However, temporary increases in reserves, such as the one observed in late 2024, coincide with price retracements.

The technical breakdown by Pillow identifies Ethereum’s most important support and resistance levels based on recent trends. Support at $1,900 is an important level, while resistance at $3,000 could govern the next breakout attempt. If the buying pressure strengthens in the presence of declining supply, bullish pressure could be back in the coming months.

According to historical trends, Ethereum’s price can continue to be volatile as exchange reserves are depleted. Pillow’s insights highlight that the dynamics between supply and demand will be instrumental in determining Ethereum’s market path.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.