SEC’s PoW Mining Exemption Sparks Confidence—Are Altcoin ETFs Next?

- The latest statement released by the US Securities and Exchange Commission (SEC) has clarified that crypto mining does not constitute securities violation.

- The report explains that both Solo Mining and Mining Pool are not undertaken with reasonable expectations for profit and, henceforth, do not require registration from the Agency.

The US Securities and Exchange Commission (SEC) has, in its latest statement, clarified that mining activities that are in connection with protocol mining do not constitute the offering and sales of securities defined in the Securities Act of 1933. According to the report reviewed by CNF, the Commission agrees that mining activities do not require transaction registrations with the SEC.

Shedding more light on this, the Division pointed out that its latest view pertains to “Mining Covered Crypto Assets on a Proof of Work (PoW) network” as well as the “the roles of mining pools and pool operators involved in the Protocol Mining process.” According to experts, this implies that mining activities for PoW tokens like Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH) would not constitute any security violations.

Fascinatingly, this position marks a significant shift from its controversial view of this activity. In its previous lawsuit against Green United, the Commission indicated that crypto-mining devices are also securities. However, the recent release clarifies that mining is merely an administrative practice.

By adding its computational resources to the network, the miner merely is engaging in an administrative or ministerial activity to secure the network, validate transactions and add new blocks, and receive rewards.

SEC’s Clarification on Solo Mining and Mining Pool

Explaining its position, SEC highlighted that Solo mining is not undertaken with reasonable expectations for profit. Instead, a computational resource is contributed by the miner with the main objective of securing the network. In doing so, he earns rewards as determined by the network. In a nutshell, the rewards are payments to the miners in exchange for their resources to secure the network.

A miner’s expectation to receive Rewards is not derived from any third party’s managerial or entrepreneurial efforts upon which the network’s success depends. Instead, the expected financial incentive from the protocol is derived from the administrative or ministerial act of Protocol Mining performed by the miner.

Speaking on the Mining Pool, the SEC explained how miners combine their computational resources to increase their chance of successfully mining a new block. Similar to Solo mining, the statement clarified that pool miners have no expectation of profit obtained from the “entrepreneurial or managerial efforts of others.”

Meanwhile, the latest development is reported to be part of the efforts of US President Donald Trump to deliver on his campaign promise to mine all remaining Bitcoin in the US, as indicated in our earlier discussion.

Per recent developments, this is just one of the several pro-crypto decisions undertaken by the SEC under the leadership of nominee Paul Atkins. In a recent update , we disclosed that the Commission has walked away from its multiple-year legal battle against Ripple Labs. Prior to that, CNF disclosed that the regulator and Binance had issued a joint motion to stay its case for 60 days.

Experts have also hinted that the latest clarification on PoW Mining could accelerate the approval of multiple spot Altcoin Exchange Traded Funds (ETF).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

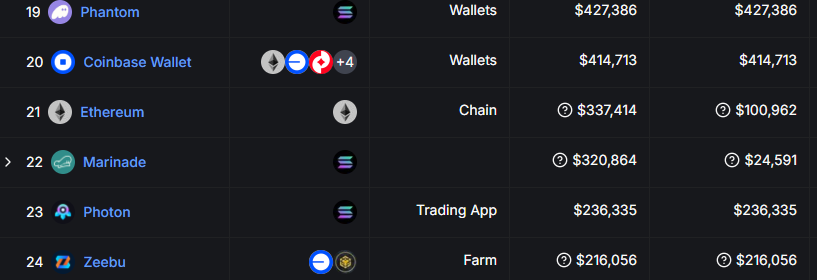

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.