Ethereum: Crypto Exchange Supply At Its Lowest Since 2015

The price of Ethereum is wavering, but some fundamental signals indicate a bullish reversal. The supply of ETH on cryptocurrency exchanges has indeed reached an unprecedented level. According to crypto experts, this could change everything.

The supply of Ethereum is melting away: towards an inevitable bullish shock?

On March 20, the analysis platform Santiment revealed a key figure: the supply of Ether available on crypto exchanges has fallen to 8.97 million ETH. This is the lowest level recorded since November 2015. Specifically, this represents a drop of 16.4% compared to the end of January balances.

This massive movement reveals a long-term accumulation strategy by crypto investors. They could be betting on the resilience of the Ethereum blockchain network.

Referred to as “supply shock”, this phenomenon describes a situation where the scarcity of a digital asset creates upward pressure if demand remains steady. According to Santiment, Ethereum holders are even withdrawing their tokens from crypto exchanges faster than ever. A similar configuration preceded a surge in the bitcoin price in early 2024.

Despite a 26% drop, Ethereum still attracts large holders

Over the last 30 days, Ethereum has lost 26% of its value. This crypto asset is now trading around $1,971. What’s worse! According to data from Farside, ETH ETFs have recorded 12 consecutive days of outflows. This represents a total of $370.6 million. This trend reflects a temporary loss of confidence among some institutional investors.

On the side of traders and crypto whales, the tone is quite different. According to some analysts, buyers will soon be in competition, leading to bidding wars. Others go further by estimating that the value of Ethereum could reach between $8,000 and $10,000. This represents a 64% increase compared to its ATH of 2021.

However, not everyone shares this optimism. Daan Crypto Trades points out, for example, that ETH is at its lowest against BTC in five years. According to him, a return to highs seems unlikely in the short term.

Between accumulation, potential supply shock, and declining liquidity, Ethereum could very well surprise to the upside. The market remains, however, volatile. Thus, caution is advised for any crypto investor, especially in light of the collapse of on-chain activity threatening Ethereum .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

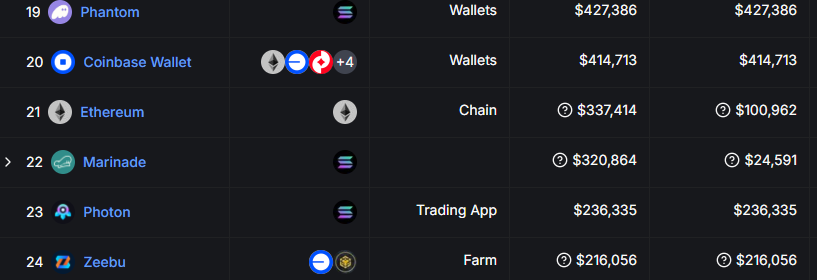

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.