Crypto Industry Super PAC Endorses Republican Candidates in Florida Special Elections

The network includes Fairshake, Protect Progress, and Defend American Jobs, the latter taking the lead in campaign spending.

A political action committee network backed by the crypto industry is throwing its weight behind two Republican candidates in Florida’s upcoming special elections for the U.S. House of Representatives, set for April 1.

The network includes Fairshake, Protect Progress, and Defend American Jobs, the latter taking the lead in campaign spending, according to a March 21 report from Politico .

Defend American Jobs has launched a $1.2 million ad campaign in support of Florida State Senator Randy Fine, who is running to fill the seat vacated by Michael Waltz.

Rep. Michael Waltz Resigns to Serve as Trump’s National Security Adviser

Waltz resigned to become President Donald Trump’s national security adviser.

Fine has voiced support for digital innovation, stating on X in January, “Floridians want crypto innovation!” and emphasizing the need for regulatory clarity in the space.

The PAC is also spending $345,000 to support Jimmy Patronis, Florida’s Chief Financial Officer, in his bid to replace former Representative Matt Gaetz, who briefly accepted a nomination to serve as U.S. Attorney General before withdrawing.

Patronis has previously advocated for exploring state investment in digital assets, requesting a feasibility report on using retirement funds for crypto-related investments.

Both Fine and Patronis secured victories in their primary elections, with Defend American Jobs spending over $500,000 on Fine’s campaign and $200,000 on Patronis, according to Federal Election Commission filings.

While the crypto-focused Super PAC Fairshake often supports candidates from both parties, Defend American Jobs has focused nearly all of its financial support on Republican candidates, according to OpenSecrets.

The group has raised and spent approximately $60 million between 2023 and 2024.

Currently, the U.S. House of Representatives has four vacant seats, including the two in Florida.

A full sweep by Democrats would narrow the Republican majority to just one seat, raising the stakes for the April 1 elections.

A Shifting Regulatory Landscape

Last month, U.S. lawmakers overturned the “DeFi broker rule ,” a regulation that would require decentralized exchanges and other digital asset brokers to report transaction details to the Internal Revenue Service (IRS).

The push to repeal the DeFi broker rule came amid a broader shift in U.S. crypto regulation following the Republican Party’s control of both the Senate and the House.

With hundreds of pro-crypto candidates winning seats in Congress, many industry leaders speculate that the U.S. government could become the most crypto-friendly administration in history.

The political shift has already had an impact.

Throughout February, the U.S. Securities and Exchange Commission (SEC) dropped multiple enforcement actions against crypto firms, signaling a change in regulatory tone.

As reported, cryptocurrency enforcement in the United States may ease under the upcoming administration of Republican President-elect Donald Trump, with regulatory priorities expected to shift.

Speaking at a legal conference in New York, current and former senior government lawyers indicated that while financial fraud cases will still be pursued, the Justice Department’s focus will likely move toward immigration enforcement, a key campaign promise of Trump.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

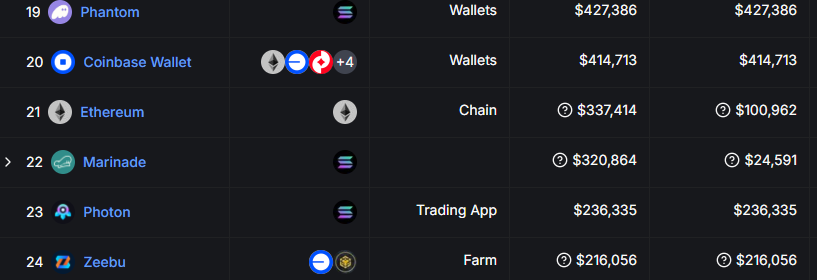

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.