Tether Collaborates with Big Four Auditor to Verify 1:1 Backing for USDT Stablecoin

The move comes amid growing industry pressure for transparency, especially in light of past controversies surrounding the company’s claims.

Tether, the issuer behind the world’s largest stablecoin USDT, is reportedly working with a Big Four accounting firm to conduct an audit of its reserves and confirm that each token is backed 1:1 with assets.

The move comes amid growing industry pressure for transparency, especially in light of past controversies surrounding the company’s claims.

Speaking to Reuters on March 21 , Tether CEO Paolo Ardoino said that a full audit is a top priority for the firm.

Tether CEO Says Trump’s Pro-Crypto Stance Could Ease Audit Process

Ardoino noted that the process could be smoother under the pro-crypto stance of U.S. President Donald Trump, who has signaled support for greater integration of digital assets.

“If the President of the United States says this is top priority for the US, Big Four auditing firms will have to listen,” he stated.

While Ardoino confirmed ongoing discussions with one of the four major firms — PwC, EY, Deloitte, or KPMG — he did not specify which was involved.

Tether currently publishes quarterly attestations, but these fall short of a full independent annual audit, which would provide stronger assurance to regulators and investors.

Tether’s USDT is designed to maintain a stable value pegged to the U.S. dollar, claiming each token is backed by a reserve made up of cash, equivalents, and other assets.

Critics, however, have long questioned the accuracy and completeness of these claims.

To strengthen its financial operations, Tether recently hired Simon McWilliams as Chief Financial Officer, signaling a more serious approach to conducting a full audit.

In September 2024, critics like Cyber Capital founder Justin Bons labeled Tether a major threat to the crypto ecosystem, citing the lack of independent verification of its reserves.

His concerns echoed the findings of Consumers’ Research, a watchdog that also questioned Tether’s transparency.

Tether was previously fined $41 million in 2021 by the CFTC for misrepresenting its reserve backing.

More recently, it has pushed back against European regulations under MiCA, which prompted exchanges like Crypto.com to delist USDT and other tokens.

Tether Engages With U.S. Lawmakers to Shape Federal Stablecoin Regulations

Last month, it was revealed that Tether has engaged with U.S. lawmakers to help shape federal regulations for the stablecoin sector.

As reported, the company has been in discussions with Representatives Bryan Steil and French Hill, key figures behind the STABLE Act introduced on Feb. 6.

Ardoino reportedly confirmed that the company is also seeking to contribute to two additional stablecoin bills proposed by other legislators.

More recently, Federal Reserve Chair Jerome Powell affirmed the central bank’s support for developing a regulatory framework around stablecoins during a Senate hearing on February 11.

Powell stated that the Federal Reserve supports the creation of a regulatory framework for stablecoins , noting the importance of protecting consumers and savers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

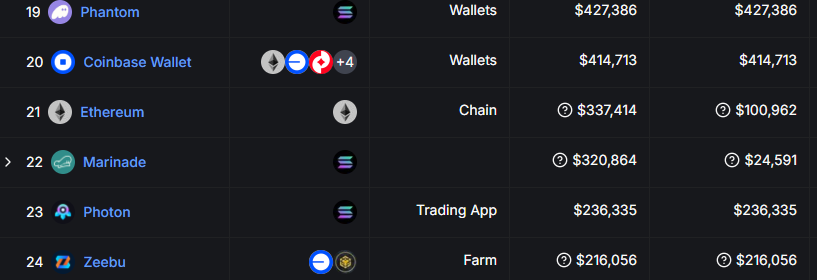

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.