Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.83%

New listings on Bitget : Pi Network

BTC/USDT$84177.40 (+1.34%)Fear at Greed Index44(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$157.8M (1D); -$22M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.83%

New listings on Bitget : Pi Network

BTC/USDT$84177.40 (+1.34%)Fear at Greed Index44(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$157.8M (1D); -$22M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR61.83%

New listings on Bitget : Pi Network

BTC/USDT$84177.40 (+1.34%)Fear at Greed Index44(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$157.8M (1D); -$22M (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

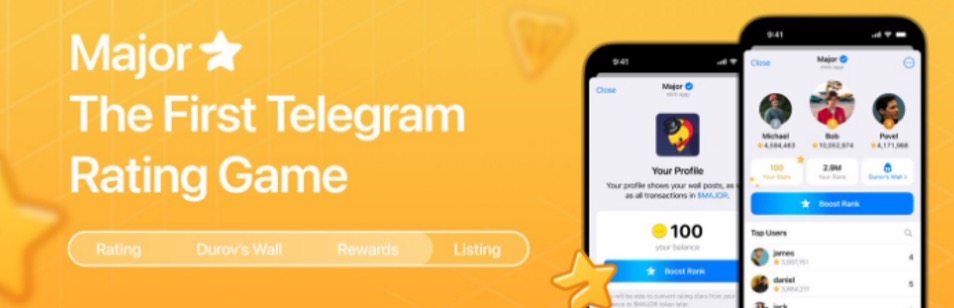

Major Frog presyoMAJOR

Hindi naka-list

Quote pera:

PHP

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

₱0.02827+2.30%1D

Price chart

Last updated as of 2025-04-02 05:54:11(UTC+0)

Market cap:₱23,889,076.3

Ganap na diluted market cap:₱23,889,076.3

Volume (24h):₱140,343,132.06

24h volume / market cap:587.47%

24h high:₱0.03041

24h low:₱0.02575

All-time high:₱4.03

All-time low:₱0.01914

Umiikot na Supply:845,000,000 MAJOR

Total supply:

987,982,551MAJOR

Rate ng sirkulasyon:85.00%

Max supply:

987,982,551MAJOR

Price in BTC:0.{8}5868 BTC

Price in ETH:0.{6}2652 ETH

Price at BTC market cap:

₱113,157.02

Price at ETH market cap:

₱15,224.8

Mga kontrata:

CNyMaR...68uCeJk(Solana)

Ano ang nararamdaman mo tungkol sa Major Frog ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Major Frog ngayon

Ang live na presyo ng Major Frog ay ₱0.02827 bawat (MAJOR / PHP) ngayon na may kasalukuyang market cap na ₱23.89M PHP. Ang 24 na oras na dami ng trading ay ₱140.34M PHP. Ang presyong MAJOR hanggang PHP ay ina-update sa real time. Ang Major Frog ay 2.30% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 845,000,000 .

Ano ang pinakamataas na presyo ng MAJOR?

Ang MAJOR ay may all-time high (ATH) na ₱4.03, na naitala noong 2024-11-18.

Ano ang pinakamababang presyo ng MAJOR?

Ang MAJOR ay may all-time low (ATL) na ₱0.01914, na naitala noong 2025-03-31.

Bitcoin price prediction

Ano ang magiging presyo ng MAJOR sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni MAJOR, ang presyo ng MAJOR ay inaasahang aabot sa ₱0.1851 sa 2026.

Ano ang magiging presyo ng MAJOR sa 2031?

Sa 2031, ang presyo ng MAJOR ay inaasahang tataas ng +30.00%. Sa pagtatapos ng 2031, ang presyo ng MAJOR ay inaasahang aabot sa ₱0.3408, na may pinagsama-samang ROI na +1116.10%.

Major Frog price history (PHP)

The price of Major Frog is -99.22% over the last year. The highest price of in PHP in the last year was ₱4.03 and the lowest price of in PHP in the last year was ₱0.01914.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+2.30%₱0.02575₱0.03041

7d-59.53%₱0.01914₱0.07476

30d-92.13%₱0.01914₱0.3153

90d-98.27%₱0.01914₱3.58

1y-99.22%₱0.01914₱4.03

All-time-97.74%₱0.01914(2025-03-31, Kahapon )₱4.03(2024-11-18, 135 araw ang nakalipas )

Major Frog impormasyon sa merkado

Major Frog's market cap history

Major Frog holdings by concentration

Whales

Investors

Retail

Major Frog addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Major Frog na mga rating

Mga average na rating mula sa komunidad

4.4

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

MAJOR sa lokal na pera

1 MAJOR To MXN$0.011 MAJOR To GTQQ01 MAJOR To CLP$0.471 MAJOR To UGXSh1.811 MAJOR To HNLL0.011 MAJOR To ZARR0.011 MAJOR To TNDد.ت01 MAJOR To IQDع.د0.651 MAJOR To TWDNT$0.021 MAJOR To RSDдин.0.051 MAJOR To DOP$0.031 MAJOR To MYRRM01 MAJOR To GEL₾01 MAJOR To UYU$0.021 MAJOR To MADد.م.01 MAJOR To AZN₼01 MAJOR To OMRر.ع.01 MAJOR To KESSh0.061 MAJOR To SEKkr01 MAJOR To UAH₴0.02

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-04-02 05:54:11(UTC+0)

Major Frog balita

Malapit nang ilunsad ang pangunahing tampok sa pagpapaupa ng NFT

Bitget•2024-12-11 02:56

![[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!](/price/_next/static/media/cover-placeholder.a3a73e93.svg)

[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!

Bitget Announcement•2024-11-14 13:40

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Major Frog.

Ano ang kasalukuyang presyo ng Major Frog?

The live price of Major Frog is ₱0.03 per (MAJOR/PHP) with a current market cap of ₱23,889,076.3 PHP. Major Frog's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Major Frog's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Major Frog?

Sa nakalipas na 24 na oras, ang dami ng trading ng Major Frog ay ₱140.34M.

Ano ang all-time high ng Major Frog?

Ang all-time high ng Major Frog ay ₱4.03. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Major Frog mula noong inilunsad ito.

Maaari ba akong bumili ng Major Frog sa Bitget?

Oo, ang Major Frog ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Major Frog?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Major Frog na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Major Frog online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Major Frog, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Major Frog. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

Cointribune EN

7h

Tether's Bitcoin Reserve Reaches 92,646 BTC After A New Purchase Of 735 Million

The fluctuations of the crypto markets often disappoint short-term traders who tremble at the sight of a decline. But for the hodlers, those long-term cryptocurrency holders, it’s a different game. They remain calm, patient, and watch the whales plunge into the oceans of Bitcoin. Among them, Tether, the giant of stablecoins, proudly showcases a recent acquisition that is making waves.

The Tether news : the first quarter of 2025 marks a turning point for the company. With the purchase of 8,888 BTC for 735 million dollars, the company sees its bitcoin reserves climb to 7.8 billion dollars. A feat that places Tether among the largest holders of bitcoin in the world, holding the 6th position in terms of volume held in a single wallet.

This acquisition is not a matter of chance, but a strategy of accumulation launched in September 2022, aimed at strengthening its reserves while diversifying its investments.

At the heart of this strategy, Tether commits to allocate 15% of its net profits every quarter to buying bitcoins. The goal? To create long-term stability while maximizing potential gains.

Despite a challenging first quarter for bitcoin, whose value has dropped by almost 12%, Tether remains one of the most profitable players in the crypto sector. 3.86 billion dollars in unrealized gains testify to the effectiveness of this approach.

The question arises: will Tether continue this aggressive strategy over the quarters, even if the market remains volatile?

Tether’s CEO, Paolo Ardoino, does not hide his love for bitcoin. According to him, this cryptocurrency is not only the most decentralized, but it also has a unique resilience power.

Bitcoin cannot be changed by anyone.

A statement that defends it against the rise of altcoins and debates about their governance. In a world where updates and changes are frequent, bitcoin remains fixed in its original form, a guarantee of reliability.

Recently, he stated that bitcoin “remains unchanged and immutable“, an argument that resonates in a context where many cryptocurrencies undergo regular changes to meet market needs.

For Ardoino, the security and stability of bitcoin make it a valuable asset for long-term investors. Can we really imagine a global financial future without bitcoin? And if the stability of its blockchain was its major asset in the coming years?

Tether is not just a stablecoin company. It is a geopolitical player in the world of cryptocurrencies. According to Paolo Ardoino, the USDT stablecoin has a strategic role: it is good for the US dollar. How? By helping to maintain the dollar’s dominance in emerging regions, such as Africa and South America, where China is trying to weave its influence.

Ardoino explains that USDT helps to decentralize the holding of the dollar, particularly in developing markets where the dollar remains essential despite the rise of the Chinese currency. Tether thus stands as a rampart against dedollarization, a global challenge that is becoming increasingly relevant with the projects of alternative currencies like those of the BRICS countries.

If these projects fail in the short term, Tether’s rise could indeed help maintain the balance.

Here are some key points about Tether’s impact on the dollar:

Tether: an essential player in preserving the supremacy of the dollar, but for how long?

Tether isn’t just satisfied with bitcoin; it is also becoming a key player in the American economy with its role as the 7th largest holder of US Treasury bonds . Tether is slowly but surely transforming into an indispensable geopolitical force in the world of cryptocurrencies and beyond.

BTC-1.15%

WAVES-5.87%

muphy

8h

Trading $IMT on Bitget: A User’s Experience & Profit Strategies

As $IMT gains traction in the crypto market, Bitget has become a key platform for traders looking to capitalize on its volatility and potential growth. Whether you're a day trader, swing trader, or long-term investor, understanding $IMT’s trading environment, liquidity, and profit-making strategies can help you maximize your returns.

1. Trading $IMT on Bitget: What to Expect?

Bitget is known for its user-friendly interface, deep liquidity, and advanced trading tools. Here’s what traders can expect when trading $IMT on Bitget:

Smooth Trading Execution: Orders are executed quickly, reducing slippage—especially for high-volume trades.

Multiple Trading Pairs: $IMT may be paired with USDT, BTC, or other major assets, offering traders flexibility.

Advanced Charting Tools: Bitget provides in-depth technical indicators, allowing traders to analyze price trends effectively.

Futures & Leverage Trading: If available, leverage trading allows traders to amplify their gains, though it also increases risk.

Security & Reliability: Bitget offers a secure trading environment with strong security measures, making it a trusted platform for trading $IMT.

2. Profit Strategies for Trading $IMT on Bitget

Making profits in crypto trading requires a strategic approach. Here are some proven strategies tailored for $IMT:

A. Scalping for Quick Profits

Strategy: Scalping involves making small but frequent trades, capitalizing on minor price movements.

Timeframe: 1-minute to 15-minute charts.

Key Indicators: Moving Averages, Bollinger Bands, and Relative Strength Index (RSI).

Execution:

Look for breakout patterns in short timeframes.

Enter and exit trades quickly, aiming for 1%-3% profit per trade.

Use tight stop-loss orders to minimize risk.

Best For: Traders who want quick, low-risk profits throughout the day.

B. Swing Trading for Mid-Term Gains

Strategy: Swing trading involves holding $IMT for a few days to weeks to capture larger price movements.

Timeframe: 4-hour to daily charts.

Key Indicators: Fibonacci Retracement, RSI, MACD (Moving Average Convergence Divergence).

Execution:

Identify key support and resistance levels.

Buy near support when RSI shows oversold conditions.

Sell near resistance when RSI indicates overbought conditions.

Use trailing stop-loss orders to protect profits.

Best For: Traders who prefer medium-term gains with lower risk than day trading.

C. Breakout Trading for Explosive Moves

Strategy: This involves entering trades when $IMT breaks key resistance levels, leading to strong upward momentum.

Timeframe: 1-hour to 4-hour charts.

Key Indicators: Volume, Moving Averages, RSI, Bollinger Bands.

Execution:

Wait for price consolidation before a breakout.

Confirm breakouts with high volume before entering a trade.

Take profits at predetermined levels to avoid getting caught in fakeouts.

Best For: Traders looking for high-reward opportunities with proper risk management.

D. Futures Trading & Leveraged Strategies

If Bitget offers futures trading for $IMT, experienced traders can use leverage to maximize gains.

Leverage Trading: Multiply your position size (e.g., 10x leverage means a 1% move results in 10% profit/loss).

Hedging Strategy: Use short positions to protect against downside risks.

Risk Management: Always use stop-loss orders to prevent liquidation.

Warning: Leverage amplifies both gains and losses. Only use it if you fully understand the risks.

3. Risk Management & Trading Psychology

Even with strong strategies, risk management and trading discipline are crucial.

A. Risk Management Tips:

Never risk more than 1%-3% of your capital per trade.

Always set stop-loss orders to minimize losses.

Use the Risk-Reward Ratio (e.g., aim for a 3:1 ratio, meaning if you risk $100, your target should be a $300 profit).

B. Trading Psychology Tips:

Avoid FOMO (Fear of Missing Out): Don’t chase green candles; wait for retracements.

Stick to Your Plan: Don’t trade emotionally—use a set strategy.

Learn from Mistakes: Keep a trading journal to analyze past trades and improve strategies.

4. Market Trends & Future Trading Potential of $IMT

$IMT’s trading potential depends on market conditions and future developments.

Bull Market Scenario: If the overall crypto market enters a bullish cycle, $IMT could see increased volume and stronger uptrends.

Bear Market Scenario: In bearish conditions, scalping and shorting strategies become more effective.

Upcoming Catalysts: Exchange listings, project updates, and partnerships could drive volatility and trading opportunities.

🆑Conclusion: Maximizing Your Trading Success on Bitget

Trading $IMT on Bitget offers various opportunities, from short-term scalping to long-term swing trading. By applying technical analysis, strong risk management, and a disciplined mindset, traders can optimize their profits while minimizing risks.$IMT

BTC-1.15%

X-9.60%

GemHunter-Ãstrââ

8h

From the Ashes: Can IMTUSDT Recover from Its Epic Crash?

The story of IMTUSDT is one of sharp rises and steep falls. Once trading at significantly higher levels, the asset has experienced a dramatic decline, leading many to wonder: Can it make a comeback?

Understanding the Decline

IMTUSDT’s price plummeted from previous highs, with recent data showing it stabilizing around $0.0106. This decline could be attributed to several factors:

Market-Wide Corrections: Crypto often moves in cycles, and IMT may have been caught in a broader downtrend.

Investor Panic: A sharp decline can lead to panic selling, pushing prices even lower.

Lack of Development Updates: If the project behind IMTUSDT hasn’t delivered on key promises, investor confidence may have weakened.

Signs of a Recovery?

Despite its struggles, IMTUSDT shows signs of bottoming out. Key factors that could support a recovery include:

Stabilization at Lower Levels: The recent sideways movement suggests that selling pressure may be subsiding.

Potential Breakout Point: If IMT can break above resistance levels, it may spark renewed buying interest.

Positive News or Partnerships: Any major announcements could act as a catalyst for price appreciation.

Is It Worth the Risk?

For investors willing to take on the risk, IMTUSDT presents an intriguing opportunity. However, managing risk through stop-loss orders and position sizing is crucial. The next few weeks will be critical in determining whether IMT rises from the ashes or remains grounded.

$IMT

MAJOR-8.06%

S-3.71%

Smith001

8h

What’s Next for $BANANAS31? Future Trading Plans & Exchange Listings

As $BANANAS31 makes its debut on Bitget Insight, investors and traders are eager to know its next moves, including potential exchange listings, upcoming roadmap developments, and strategic plans that could drive its price action. Below is a deep analysis of what’s next for $BANANAS31.

1. Potential Exchange Listings: Expanding Market Reach

One of the biggest catalysts for any new cryptocurrency is wider exchange adoption. Currently, $BANANAS31 is gaining traction on Bitget Insight, but traders are looking ahead to potential listings on major centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Binance & KuCoin Prospects: If $BANANAS31 gains momentum, listing on tier-1 exchanges like Binance or KuCoin could significantly boost liquidity and trading volume.

DEX Expansion (Uniswap, PancakeSwap, etc.): A push towards decentralized trading could enhance accessibility for DeFi users. More trading pairs with stablecoins (USDT, USDC) and major cryptocurrencies like ETH or BNB would increase adoption.

Regional Exchange Partnerships: Targeting region-specific exchanges (like OKX for Asia or Bitso for Latin America) could help $BANANAS31 tap into different global markets.

Impact of Listings:

Increased trading volume and liquidity

Exposure to new investors and institutional traders

Potential price surge due to increased demand

2. Upcoming Roadmap & Development Plans

The long-term success of $BANANAS31 depends not just on exchange listings but also on technological advancements, partnerships, and ecosystem expansion.

Key Roadmap Highlights to Watch:

Utility Expansion: Will $BANANAS31 introduce staking, farming, or a utility token within its ecosystem? If so, that could increase demand.

Partnerships with DeFi & NFT Projects: Collaborations with established DeFi protocols, gaming projects, or NFT marketplaces could boost utility and adoption.

Smart Contract Upgrades: Implementing security enhancements and gas fee optimizations could make $BANANAS31 more attractive to developers and users.

Governance Mechanism: Introduction of a DAO (Decentralized Autonomous Organization) would allow the community to vote on future developments.

3. Trading Plans & Price Outlook

As $BANANAS31 gains attention, traders are strategizing their next moves based on market trends, technical analysis, and whale activity.

Short-Term Trading Strategies

Breakout Trading: Watching for resistance levels; a breakout above key resistance could trigger a bullish move.

Scalping & Swing Trading: High volatility may offer quick-profit opportunities in short-term trades.

News-Based Trading: Monitoring announcements about exchange listings, partnerships, or roadmap progress for potential price catalysts.

Long-Term Investment Potential

If $BANANAS31 secures listings on top exchanges, its liquidity and price stability could improve.

Expansion into DeFi, NFTs, or GameFi could provide real-world utility, attracting long-term holders.

A strong community and governance model would make the project more decentralized and sustainable.

Key Price Levels to Watch:

Support Zones: Identifying strong buying levels where traders might accumulate more.

Resistance Breakouts: A move above a major resistance could confirm a new bullish trend.

Final Thoughts

$BANANAS31 has significant potential to become a strong player in the crypto market. With new exchange listings, strong development plans, and an active trading community, the next few months will be crucial in determining its long-term trajectory. Traders should stay informed, watch for major announcements, and adjust their strategies accordingly.$BANANAS31

MOVE-2.70%

BANANAS31-1.63%

Smith001

8h

Trading $IMT on Bitget: Liquidity, Spreads & User Experience

As $IMT gains traction on Bitget, traders are analyzing its liquidity, trading spreads, and overall user experience to determine how it fits into their portfolio. Whether you’re a day trader, swing trader, or long-term investor, understanding these factors is crucial for optimizing your trading strategy.

1. Liquidity: How Easily Can You Trade $IMT?

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. High liquidity means:

Tighter bid-ask spreads (lower trading costs)

Faster execution of trades

Less price slippage on large orders

Liquidity Analysis for $IMT on Bitget

Since $IMT is relatively new on Bitget, its liquidity is still developing. Key factors influencing liquidity include:

Trading Volume: Higher volume leads to smoother transactions and less price volatility.

Market Maker Support: If Bitget provides strong market maker backing, order books will be deeper, reducing spread fluctuations.

Listing on Other Exchanges: More listings generally increase arbitrage opportunities, boosting liquidity.

Current State: If $IMT’s order book depth is thin, traders might experience slippage, especially on large trades. However, as more users engage with $IMT on Bitget, liquidity should improve.

2. Trading Spreads: How Much Are You Paying?

The bid-ask spread is the difference between the highest price buyers are willing to pay and the lowest price sellers are asking for. A tight spread means lower trading costs, while a wide spread can eat into profits.

Factors Affecting $IMT’s Spread on Bitget

Market Demand: If there’s high buying and selling activity, spreads will tighten.

Liquidity Providers: If major traders or automated market makers enter, spreads will decrease.

Trading Pairs: The USDT pairing generally has better spreads than lower-volume pairs like BTC or ETH.

Current State: If $IMT’s spreads are wider than major tokens, traders should be cautious with market orders and consider limit orders to avoid unfavorable prices.

3. Order Execution & Trading Experience

Bitget is known for its smooth trading interface, but how does it perform with $IMT?

Execution Speed & Slippage

Fast Execution: If $IMT has strong liquidity, traders can expect near-instant order fulfillment.

Slippage Issues: If liquidity is low, large market orders might be filled at higher prices than expected.

Trading Tip: Use limit orders to control execution price and avoid unnecessary slippage.

Trading Features on Bitget

Spot Trading: Ideal for long-term investors who want to hold $IMT.

Futures & Margin Trading: If Bitget introduces leverage trading for $IMT, it could lead to higher trading volume but also increased volatility.

Copy Trading: Bitget’s social trading feature allows beginners to follow experienced traders’ strategies with $IMT.

4. How to Optimize Your $IMT Trading Strategy on Bitget

To trade $IMT effectively on Bitget, consider these strategies:

For Short-Term Traders:

Monitor Liquidity & Spread: Check order book depth before placing large trades.

Use Limit Orders: Avoid market orders to prevent slippage.

Leverage Bitget’s Tools: Set stop-loss and take-profit orders for risk management.

For Long-Term Holders:

Look for Dips: Buy during low-volume periods to get better entry prices.

Stake or Earn Rewards: If Bitget introduces staking for $IMT, it could provide passive income.

Final Thoughts: Is Bitget the Best Platform for $IMT Trading?

Bitget offers a solid trading experience, but $IMT’s liquidity and spreads will improve as more traders join. For now, cautious execution strategies (like limit orders) are recommended to avoid high slippage and trading costs.$IMT

BTC-1.15%

HOLD+0.17%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Major Frog sa market cap.