Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.64%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$88093.57 (-0.17%)Fear and Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$84.2M (1D); +$769.3M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.64%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$88093.57 (-0.17%)Fear and Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$84.2M (1D); +$769.3M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.64%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$88093.57 (-0.17%)Fear and Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$84.2M (1D); +$769.3M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Monsterra (MSTR) priceMSTR

Listed

Quote currency:

USD

$0.001168-0.53%1D

Price chart

TradingView

Last updated as of 2025-03-25 20:37:10(UTC+0)

Market cap:$77,359.24

Fully diluted market cap:$77,359.24

Volume (24h):$5,524.67

24h volume / market cap:7.14%

24h high:$0.001256

24h low:$0.001110

All-time high:$1.13

All-time low:$0.0009574

Circulating supply:66,255,556 MSTR

Total supply:

98,700,000MSTR

Circulation rate:67.00%

Max supply:

--MSTR

Price in BTC:0.{7}1322 BTC

Price in ETH:0.{6}5616 ETH

Price at BTC market cap:

$26,447.1

Price at ETH market cap:

$3,785.59

Contracts:

0xE397...86925f9(Avalanche C-Chain)

More

How do you feel about Monsterra (MSTR) today?

Note: This information is for reference only.

Price of Monsterra (MSTR) today

The live price of Monsterra (MSTR) is $0.001168 per (MSTR / USD) today with a current market cap of $77,359.24 USD. The 24-hour trading volume is $5,524.67 USD. MSTR to USD price is updated in real time. Monsterra (MSTR) is -0.53% in the last 24 hours. It has a circulating supply of 66,255,556 .

What is the highest price of MSTR?

MSTR has an all-time high (ATH) of $1.13, recorded on 2022-08-16.

What is the lowest price of MSTR?

MSTR has an all-time low (ATL) of $0.0009574, recorded on 2025-03-16.

Monsterra (MSTR) price prediction

What will the price of MSTR be in 2026?

Based on MSTR's historical price performance prediction model, the price of MSTR is projected to reach $0.001311 in 2026.

What will the price of MSTR be in 2031?

In 2031, the MSTR price is expected to change by +12.00%. By the end of 2031, the MSTR price is projected to reach $0.001982, with a cumulative ROI of +65.25%.

Monsterra (MSTR) price history (USD)

The price of Monsterra (MSTR) is -99.27% over the last year. The highest price of MSTR in USD in the last year was $0.2659 and the lowest price of MSTR in USD in the last year was $0.0009574.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-0.53%$0.001110$0.001256

7d+1.76%$0.001087$0.001458

30d-41.22%$0.0009574$0.005216

90d-76.28%$0.0009574$0.008084

1y-99.27%$0.0009574$0.2659

All-time-99.42%$0.0009574(2025-03-16, 10 days ago )$1.13(2022-08-16, 2 years ago )

Monsterra (MSTR) market information

Monsterra (MSTR)'s market cap history

Monsterra (MSTR) holdings by concentration

Whales

Investors

Retail

Monsterra (MSTR) addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Monsterra (MSTR) ratings

Average ratings from the community

4.6

This content is for informational purposes only.

About Monsterra (MSTR) (MSTR)

What Is Monsterra?

Monsterra is a play-to-earn game operated on the BNB, Avalanche, and OKX networks. Inspired by the likes of Axie Infinity and the strategic gameplay elements of Supercell’s Clash of Clans and Boom Beach, Monsterra offers a unique blend of NFT gaming with a deep focus on free-to-play and earn mechanics. Set within a vividly imagined world, players are introduced to farming, property development, and competitive battles against others, all revolving around the captivating creatures known as Mongens. This approach not only aims to engage gamers but also provides them with a profitable avenue through the play-to-earn model.

In the world of Monsterra, players embark on an adventure in a land shaped by the mythical Great Tree, whose essence gave birth to the Mongen races. These races, including Celest, Chaos, Beast, Mystic, and Tectos, coexist to guard their world against the forces of chaos that threaten their existence. Monsterra's storytelling, rich lore, and character design set it apart, offering a narrative depth that invites players to immerse themselves fully in its universe. The game's dual focus on entertainment and earning potential caters to a wide users, from blockchain enthusiasts to traditional gamers seeking novel experiences.

Resources

Official Documents:

https://whitepaper.monsterra.io/

Official Website:

https://monsterra.io/

How Does Monsterra Work?

At its core, Monsterra leverages the blockchain to create a decentralized gaming experience where players truly own their in-game assets as Non-Fungible Tokens (NFTs). This ownership extends to Mongens, the game's primary characters, land plots, and various items used within the game’s ecosystem. Players begin their journey with a set of basic in-game assets, which can be expanded through gameplay, strategic planning, and participation in the game's economy. The game’s mechanics encourage players to engage in farming, breeding, and battling to grow their assets, enhance their Mongens, and expand their territories.

Monsterra introduces a balanced game economy designed to prevent inflation and ensure long-term sustainability, a common challenge in play-to-earn games. This is achieved through smart contract-based mechanisms that regulate the minting and burning of tokens, alongside creative gameplay features that encourage active participation. The game's energy system, for instance, requires players to strategize their actions based on a limited daily energy resource, making each decision impactful. Furthermore, the game supports a multi-chain framework, allowing for a wider accessibility and reduced transaction fees, enhancing the overall player experience.

What Is MSTR Token?

MSTR is the native token of the Monsterra. It is designed to facilitate various transactions within the Monsterra ecosystem, including the purchase of land, Mongens, and other in-game assets from the marketplace. Beyond its transactional utility, MSTR plays a crucial role in the game's play-to-earn model, enabling players to stake their tokens in pools to earn rewards and participate in the governance of the Monsterra DAO (Decentralized Autonomous Organization). MSTR token also incorporates mechanisms for staking, rewards, and a strategic burning policy to maintain economic balance and reduce inflationary pressures. MSTR has a total supply of 100 million tokens.

What Determines Monsterra’s Price?

The price of Monsterra (MSTR) is influenced by a combination of factors inherent to the dynamics of

blockchain technology and Web3 innovations, much like other digital assets in the cryptocurrency market. Supply and demand play a critical role, where increased adoption and engagement within the Monsterra ecosystem can lead to higher demand for MSTR tokens. This is further impacted by the latest news, developments in cryptocurrency regulation, and overall market volatility. As Monsterra gains traction as a leading play-to-earn game, its valuation is closely watched by investors analyzing cryptocurrency charts and trends for the best crypto investment opportunities in 2024 and beyond.

Furthermore, Monsterra's price is subject to the broader ecosystem's health, including cryptocurrency risks, security concerns, and the pace of cryptocurrency adoption. The play-to-earn model, powered by blockchain, opens up new avenues for gaming and investment but also introduces new variables to the token's valuation. Latest developments in Web3 and play-to-earn games, alongside

cryptocurrency analysis and price predictions, are key indicators for understanding MSTR's potential as an investment. As the blockchain landscape evolves with new technology and regulatory frameworks, these elements collectively shape Monsterra's market position and future price trajectory.

For those interested in investing or trading Monsterra, one might wonder: Where to buy MSTR? You can purchase MSTR on leading exchanges, such as Bitget, which offers a secure and user-friendly platform for cryptocurrency enthusiasts.

MSTR to local currency

1 MSTR to MXN$0.021 MSTR to GTQQ0.011 MSTR to CLP$1.071 MSTR to HNLL0.031 MSTR to UGXSh4.281 MSTR to ZARR0.021 MSTR to TNDد.ت01 MSTR to IQDع.د1.531 MSTR to TWDNT$0.041 MSTR to RSDдин.0.131 MSTR to DOP$0.071 MSTR to MYRRM0.011 MSTR to GEL₾01 MSTR to UYU$0.051 MSTR to MADد.م.0.011 MSTR to OMRر.ع.01 MSTR to AZN₼01 MSTR to SEKkr0.011 MSTR to KESSh0.151 MSTR to UAH₴0.05

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-25 20:37:10(UTC+0)

How to buy Monsterra (MSTR)(MSTR)

Create Your Free Bitget Account

Sign up on Bitget with your email address/mobile phone number and create a strong password to secure your account.

Verify Your Account

Verify your identity by entering your personal information and uploading a valid photo ID.

Convert Monsterra (MSTR) to MSTR

Use a variety of payment options to buy Monsterra (MSTR) on Bitget. We'll show you how.

Learn MoreTrade MSTR perpetual futures

After having successfully signed up on Bitget and purchased USDT or MSTR tokens, you can start trading derivatives, including MSTR futures and margin trading to increase your income.

The current price of MSTR is $0.001168, with a 24h price change of -0.53%. Traders can profit by either going long or short onMSTR futures.

Join MSTR copy trading by following elite traders.

After signing up on Bitget and successfully buying USDT or MSTR tokens, you can also start copy trading by following elite traders.

Monsterra (MSTR) news

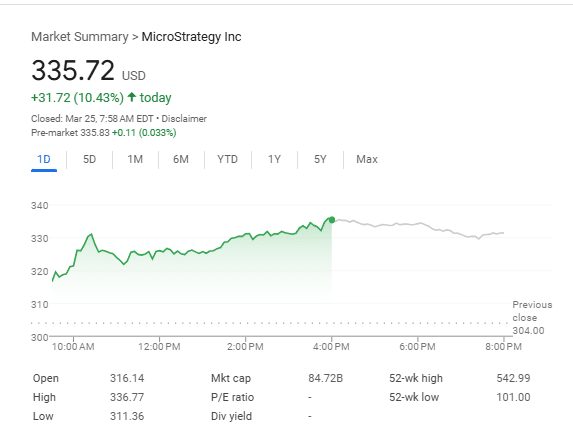

MicroStrategy (MSTR) Stock Jumps 10%, Eyes $700 Target by June

Cryptotimes•2025-03-25 16:55

Strategy Crosses The Threshold Of 500,000 BTC After A New Purchase Of Bitcoins

Cointribune•2025-03-25 10:33

Crypto Stocks Price Soars As SEC Takes Blind EYE!

Cryptotimes•2025-03-25 00:33

U.S. stocks extend further intraday gains as Tesla rises more than 10.46 per cent

Bitget•2025-03-24 18:57

KULR buys another $5 million worth of bitcoin, taking the Strategy-emulator's total holdings to 668 BTC

Quick Take KULR Technology Group has purchased another $5 million worth of bitcoin. The thermal management solution firm’s total holdings now stand at 668.3 BTC.

The Block•2025-03-24 16:00

Buy more

FAQ

What is the current price of Monsterra (MSTR)?

The live price of Monsterra (MSTR) is $0 per (MSTR/USD) with a current market cap of $77,359.24 USD. Monsterra (MSTR)'s value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Monsterra (MSTR)'s current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of Monsterra (MSTR)?

Over the last 24 hours, the trading volume of Monsterra (MSTR) is $5,524.67.

What is the all-time high of Monsterra (MSTR)?

The all-time high of Monsterra (MSTR) is $1.13. This all-time high is highest price for Monsterra (MSTR) since it was launched.

Can I buy Monsterra (MSTR) on Bitget?

Yes, Monsterra (MSTR) is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy Monsterra guide.

Can I get a steady income from investing in Monsterra (MSTR)?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy Monsterra (MSTR) with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy Monsterra (MSTR) (MSTR)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying Monsterra (MSTR) online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Monsterra (MSTR), and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Monsterra (MSTR) purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

Cointribune EN

10h

Strategy Crosses The Threshold Of 500,000 BTC After A New Purchase Of Bitcoins

Strategy, ex-MicroStrategy, has not changed its name by chance: the company waited to approach the threshold of 500,000 bitcoins to do so. Having crossed this milestone, it now boasts a historic digital vault. By engraving this step in the cryptographic stone, it offers itself a prime place in the pantheon of crypto investors. And like a victory that never comes alone, it has just added nearly 7,000 BTC to its collection.

And there you have it! Another Monday where Michael Saylor, already armed with a historic investment plan , played the crypto market Monopoly with real money. Thanks to a purchase of 6,911 BTC for the modest sum of 584 million dollars, Strategy, the new flashy name for MicroStrategy, now holds 506,137 BTC . One could say that there are soon no crumbs left for others.

The average acquisition cost of this latest batch? A modest $84,529 per piece. And in total, Strategy has invested nearly $33.7 billion in Bitcoin, at an average price of $66,608. A true all-in crypto, modern gladiator style.

As of today, Saylor’s company holds 2.4% of the total existing BTC supply. And guess what? He does not intend to stop there.

But why this symbolic figure of 500,000 BTC? Why this obsession with holding so much of a digital asset? And above all, what happens when you become richer than some countries? That would warrant a world map and a good coffee.

While some seek the key to success, Michael Saylor has built the vault. And to fill it, he even raised an additional $711 million through the sale of preferred STRF shares at 10%, proving that appetite comes with buying.

Thanks to this massive fundraising , Strategy is already planning to further bolster its Bitcoin reserves. It must be said that this latest share issuance brought in more than expected: 8.5 million shares sold at $85 each, far exceeding the initial $500 million anticipated.

« $MSTR acquired 6,911 BTC for $584 million at an average price of $84,529 per bitcoin » proudly tweeted Saylor. One can feel the financial ecstasy behind each word.

The most surprising? The crypto market hardly flinched. The price of BTC , on the other hand, is calmly hovering above $87,000, despite this historic announcement. As if investors had already absorbed the fact that Saylor will buy up all the stock sooner or later.

And now? A strategy of 100,000 more BTC? A new fundraising? Or just the desire to become the living vault of the crypto planet? Bets are open.

In addition to encouraging Washington to invest massively in Bitcoin, Michael Saylor now dreams of a BTC strategy… at $100 trillion. Just that.

WHY+7.02%

BTC+0.68%

Cointelegraph

13h

🔥 NOW: Michael Saylor says, "Bitcoin is a magnet for capital" in response to VanEck's Matthew Sigel post showing BTC's outsized capital raising impact.

While $MSTR represents just 0.07% of US equities by value, Bitcoin-related offerings account for 16% of all equity raised in 2024.

BTC+0.68%

S+3.33%

Coinedition

1d

Bitcoin’s Corporate Backers Grow: Top 70 Companies Now Hoard 670K+ BTC

The trend of institutional investors embracing Bitcoin continues to gain momentum, with the “HODL Top 70” list of companies now collectively holding a staggering 670,153 BTC.

This increasing accumulation of Bitcoin by corporate entities reflects a growing confidence in the cryptocurrency’s long-term value proposition. In the past week alone, five companies further expanded their digital asset portfolios, adding a total of 7,349 BTC to their already substantial reserves.

Which Companies Are Leading the Charge in Bitcoin Accumulation?

When it comes to individual corporate Bitcoin holdings, Strategy (MSTR) remains the undisputed leader , currently possessing an impressive 506,137 BTC. The company’s well-known and aggressive Bitcoin accumulation strategy keeps it significantly ahead of all other publicly traded firms in this space.

Following Strategy is Marathon Digital (MARA) with a substantial 46,374 BTC, maintaining its position as a key player in the Bitcoin mining industry. Riot Platforms (RIOT) holds 18,692 BTC, further demonstrating its strong commitment to Bitcoin as a core asset in its treasury.

Related: Strategy (Formerly MicroStrategy) Launches $2.1 Billion Share Sale to Fund Further Bitcoin Acquisitions

Tesla (TSLA) continues to hold a significant amount of Bitcoin, retaining 11,509 BTC, which reflects its sustained investment in the cryptocurrency despite the market’s inherent volatility.

Cleanspark (CLSK) has accumulated 11,177 BTC, further solidifying its position within the Bitcoin mining sector. Hut 8 (HUT) closely follows with 10,237 BTC, remaining one of the industry’s leading Bitcoin mining companies.

Coinbase (COIN), a major cryptocurrency exchange, holds 9,480 BTC, ensuring it has significant exposure to Bitcoin’s price fluctuations.

Block (formerly known as Square) owns a notable 8,485 BTC, underscoring its long-term belief in Bitcoin’s potential as a transformative technology and asset. Galaxy Digital (GLXY), a prominent investment firm focused on digital assets, holds 4,848 BTC, showcasing its commitment to Bitcoin as a key component of the evolving financial landscape.

Bitcoin Group SE (BTGGF), a European institutional investor, has accumulated 3,605 BTC, further strengthening its presence in the Bitcoin market.

Metaplanet recently increased its holdings, now reaching a total of 3,350 BTC. This strategic move aligns with the company’s publicly stated bullish outlook on Bitcoin’s future.

Semler Scientific (SMLR) holds 3,192 BTC, maintaining a significant corporate stake in the cryptocurrency. Hive Digital (HIVE) possesses 2,620 BTC, supporting its operations in the digital asset mining space.

Cango (CANG) has also increased its exposure to Bitcoin, now holding 1,944 BTC. Exodus (EXOD) follows with 1,900 BTC, using Bitcoin as part of its reserves to support its digital wallet services.

BitFuFu (FUFU) owns 1,800 BTC, reflecting the broader trend of increasing institutional adoption of Bitcoin. Nexon (NEXOF) holds 1,717 BTC, demonstrating continued corporate confidence in Bitcoin’s long-term value as an asset.

Related: Bitcoin Bet Pays Off: Strategy₿ (MSTR) Outperforms Top Stocks

Fold (FLD) has accumulated 1,485 BTC, highlighting its ongoing commitment to the cryptocurrency ecosystem. Canaan (CAN), a major manufacturer of Bitcoin mining hardware, holds 1,355 BTC, maintaining its presence within the Bitcoin industry.

This sustained and growing institutional adoption signals a strong and enduring corporate belief in Bitcoin’s potential as a valuable long-term investment asset.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

BTC+0.68%

CORE-1.71%

Michael Saylor_

1d

$MSTR has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, @Strategy holds 506,137 BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin. $STRK

BTC+0.68%

STRK+1.69%

Crypto News Flash

3d

MicroStrategy to Raise $711M for Bitcoin—Bullish Signal for BTC?

Strategy, previously named MicroStrategy , is scaling up its Bitcoin mission . Through a combination of confidence and capital, the firm has registered an offering of 8.5 million shares of its 10% Series A Perpetual Strife Preferred Stock at $85 per share. The scheme is anticipated to generate an enormous $711.2 million, funds heading straight into Bitcoin and boosting its day-to-day finances.

Strategy announces pricing of its Strife Perpetual Preferred Stock ($STRF) Offering and upsizes the deal from $500M to $722.5M $MSTR https://t.co/GJVCRwIQ0Y

— Michael Saylor⚡️ (@saylor) March 21, 2025

The offering that will be closing on Tuesday, March 25, 2025, guarantees investors a 10% annual dividend return. Strategy’s decision to raise almost $211 million more than planned reflects strong investor demand and, perhaps, a growing conviction in the long-term value of Bitcoin. Initially, the company targeted to sell $500 million with only 5 million shares of the same stock.

Strategy purchased a whole batch of 130 BTC this week for $10.7 million, which means they spent $82,982 on each BTC on average. The most recent transaction raised the value of the company’s Bitcoins to 499,226, which is around 2.37% of all the Bitcoins that are currently in circulation.

Founder and chairman Michael Saylor hasn’t been shy about his endgame. “Bitcoin is our strategy,” he has made clear through both word and wallet. By using this, a novel model has arisen within Strategy in which not only crypto is being held, but its use has led to the establishment of a fully functional business model.

Some companies might take a small step, but Strategy goes the whole hog. After the sale of 123,000 shares of 8.00% Series A Perpetual Strike Preferred Stock, the company rose to the sum of $10.7 million. The exact amount was used to buy 130 Bitcoins. Furthermore, in a world where treasuries typically mean cash or bonds, this kind of discipline is unique.

As a matter of fact, Strategy actually has not sold any A Class common stock in the recent past to imply its determination based on the progressive financial task and only through the current and future Bitcoin-centric strategy. This is not only a crypto investment , it is a financial philosophy in action.

Strategy is one such example. Reports show that 170 institutions, including governments and fund managers, are now holding around 3.1 million Bitcoins in their treasuries. The message is loud—Bitcoin is no longer fringe. It is now an integral part of the financial mainstream that defends against inflation and currency instability.

To expand its capital firepower, Strategy has greenlit plans to issue up to $21 billion worth of its 8.00% Series A Perpetual Strike Preferred Stock using an at-the-market offering program. This may seem excessive, but in the volatile world of crypto, liquidity is king, and boldness gets rewarded—or punished—with equal speed.

On the dividend front, the company also declared a quarterly payout of $1.24 per share on its existing 8.00% Series A Perpetual Strike Preferred Stock. Starting in 2025, these payments will land every quarter, sweetening the deal for investors willing to ride out the volatility.

BTC+0.68%

UP-0.20%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to Monsterra (MSTR) in market cap.